Dear First Mates,

Hello everyone. Welcome to this month’s newsletter, where I aim to demystify alternative investments. Alternative investments are generally defined as anything other than traditional stocks or bonds. They are investments not traded on an exchange or in the public markets.

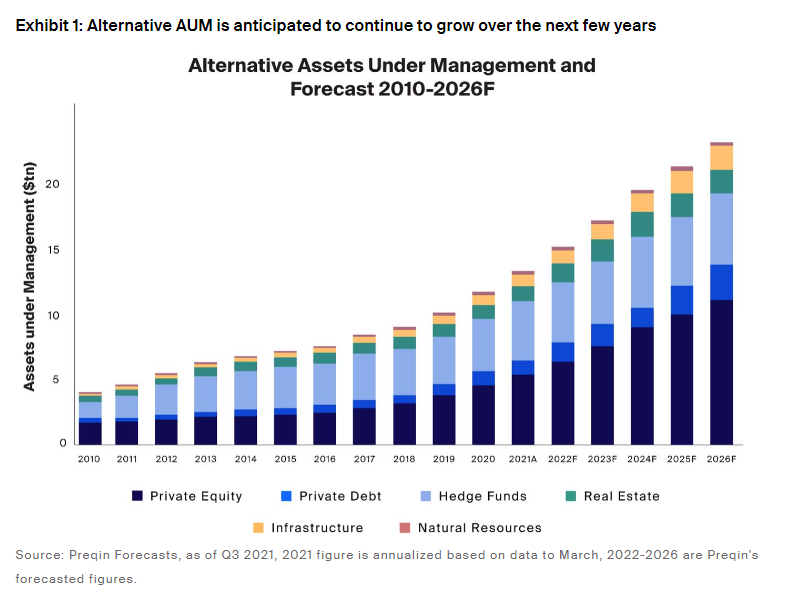

Assets under management (AUM) for alternatives have almost tripled over the last decade to roughly $13.3 trillion in 2021 and could grow to over $23.2 trillion by 2026.

Alternative asset classes include:

- Private Equity

- These assets entail owning shares of private businesses. I covered this asset class in detail in my August 2022 newsletter entitled “Private Equity.”

- Private Credit

- These assets entail lending money to private businesses. I covered this asset class in detail in my September 2022 newsletter entitled “Private Credit.”

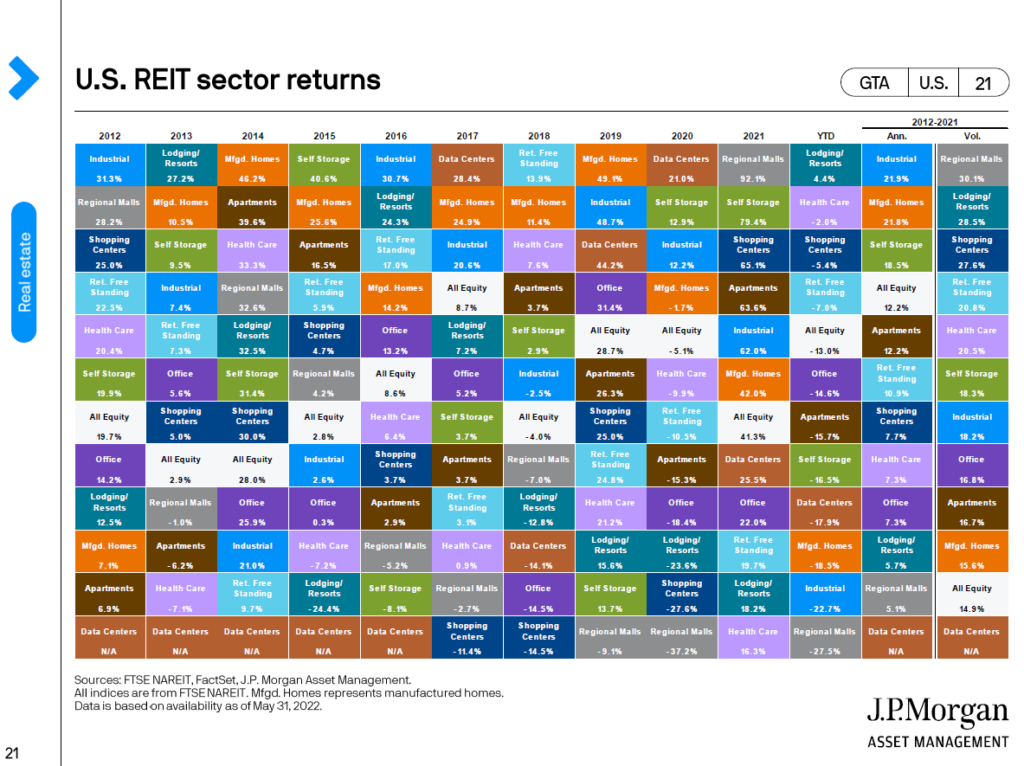

- Real Estate

- Real estate is generally defined as tangible property consisting of land, buildings, and related structures. I covered real estate in detail in my July 2022 newsletter entitled “All About Real Estate.”

- Real Assets

- Real assets are the broad term for investments in physical assets, commonly including infrastructure, natural resources, and sometimes real estate.

- Hedge Funds

- These funds offer greater flexibility in the number of underlying investments (equity, fixed income, commodities, currencies, options, and futures), and the managers can be long and short market segments.

- Art & Collectibles

- Digital Assets

- These digital assets leverage blockchain technology with the two largest cryptocurrencies being Bitcoin and Ethereum. I covered crypto in three newsletters, including May 2021 – Crypto I, June 2021-Crypto II, and July 2021 – Crypto III. Whoa!

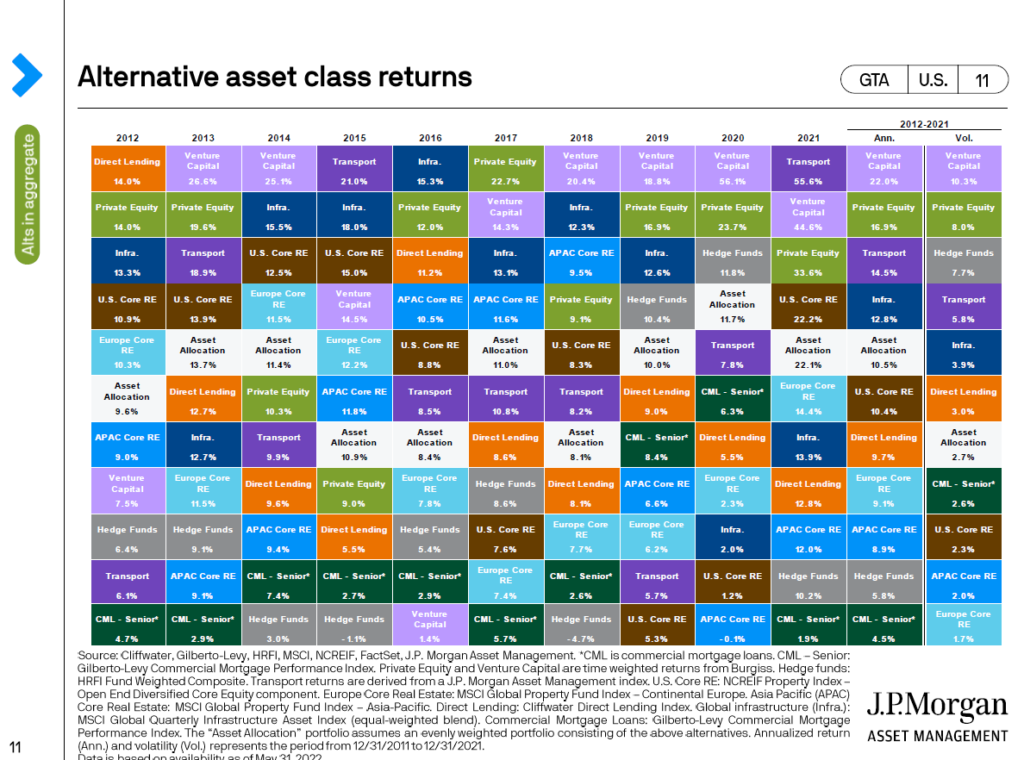

Below you can see three periodic tables of returns in the alternative investment universe.

The advantages of utilizing alternatives in your portfolio may include:

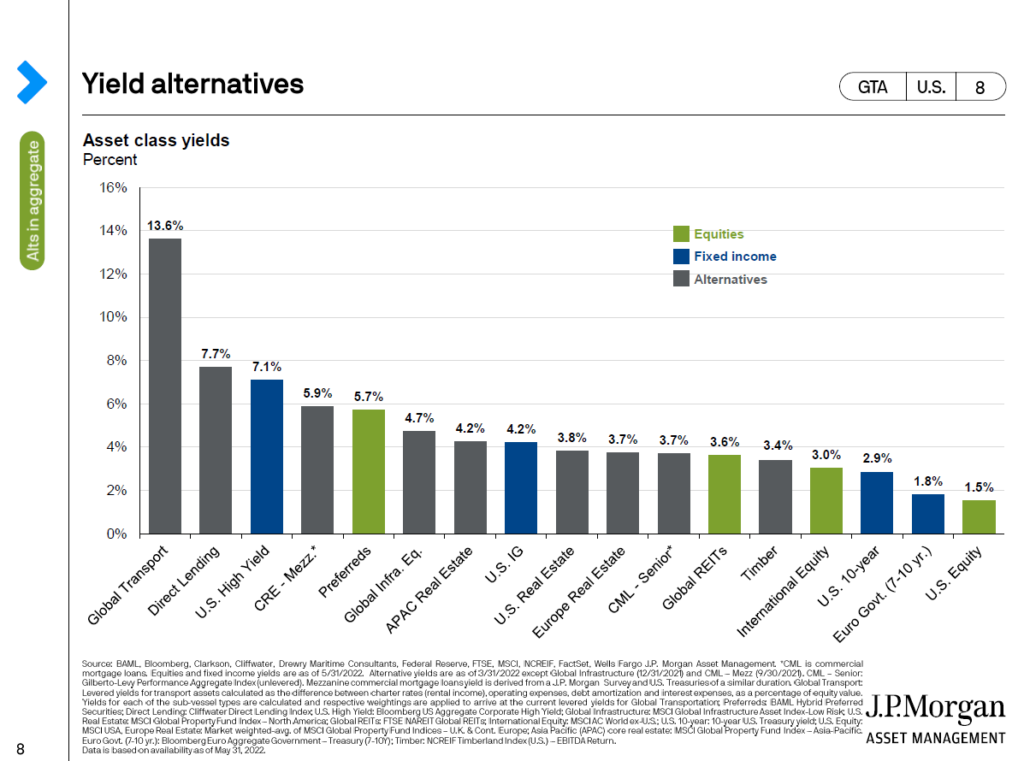

- Providing high levels of current income (yield)

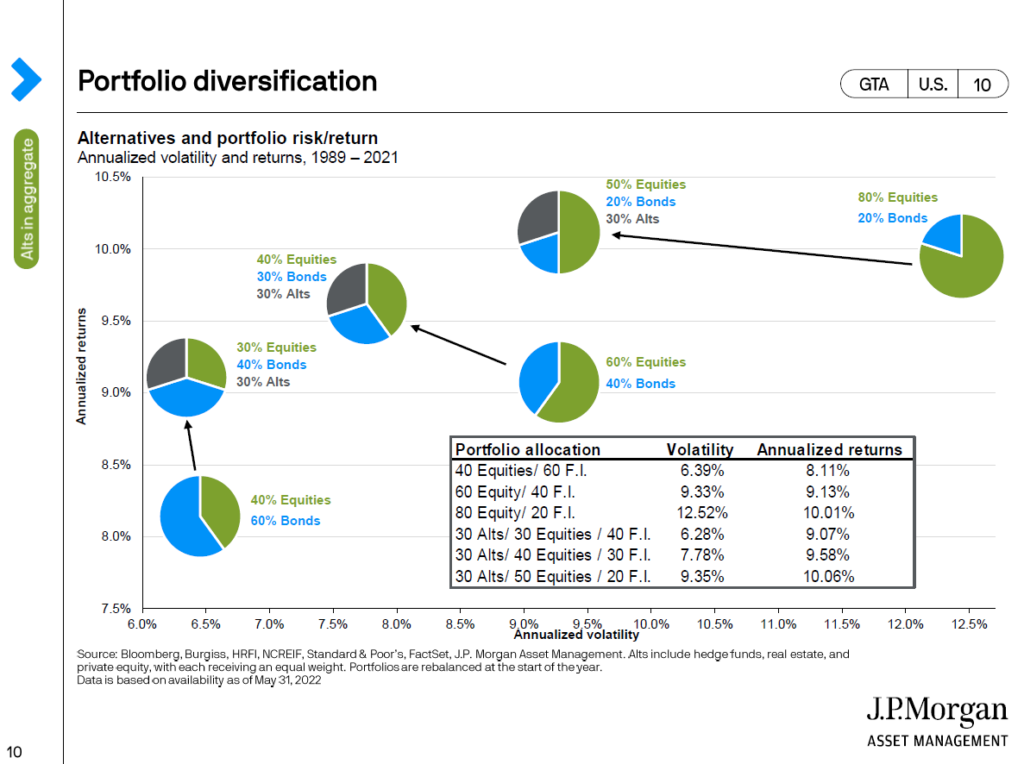

- Enhancing portfolio diversification

- Lowering portfolio volatility

- Potential for higher returns

A key feature that makes alternatives attractive today is that they currently generate higher income than cash or bonds.

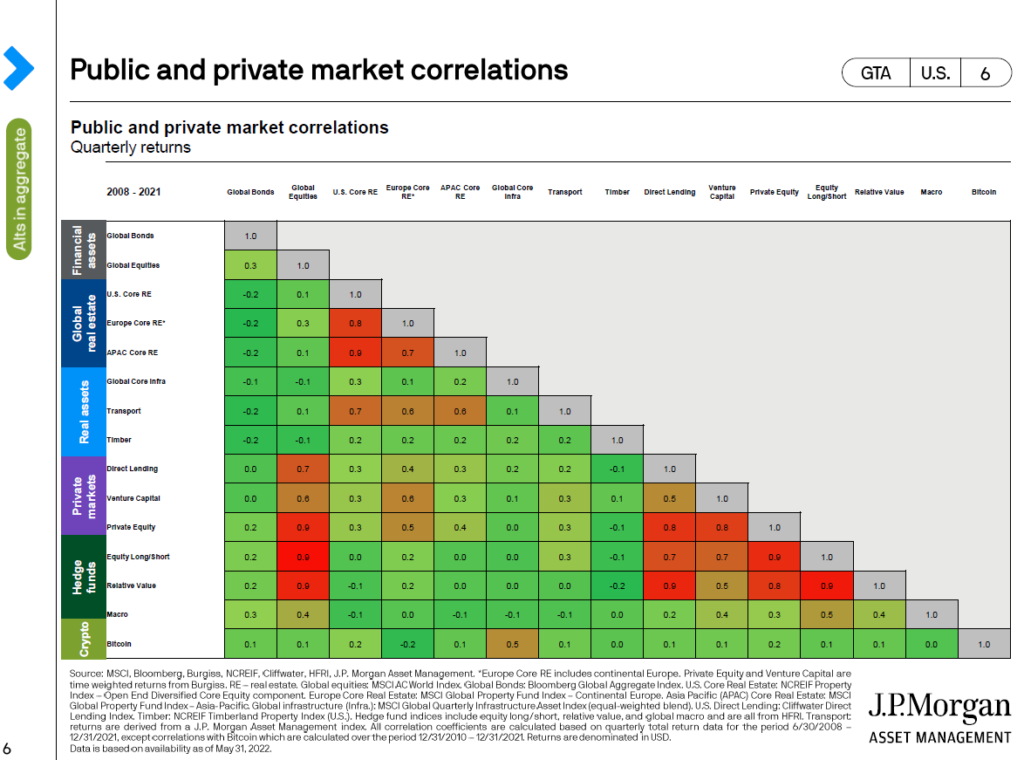

I have repeatedly written how alternatives can enhance a portfolio’s diversification. Through low correlations, there is potential for higher returns and lower volatility by utilizing these investments.

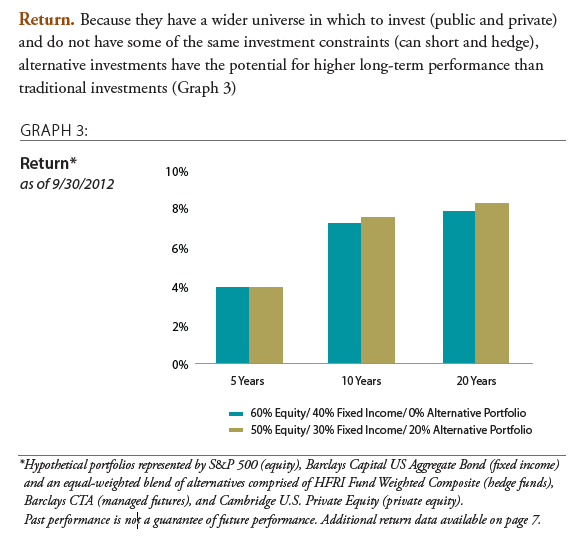

Alternative investments have the potential for higher returns since they utilize different asset classes than traditional investments.

Alternative investments do possess their own inherent set of risks – some of which include:

- Higher fees

- Fund sponsors typically charge a management fee as well as an incentive fee

- More complicated

- Less transparency

- Less liquid

- Investors should know how long their funds are locked up for

- Less tax-friendly

- Fund sponsors can issue a K1 that may delay your tax-filing

- Leverage

- Leverage can magnify both risk and return

- May disappoint in both up and down markets

You can read more about the risks in more detail here.

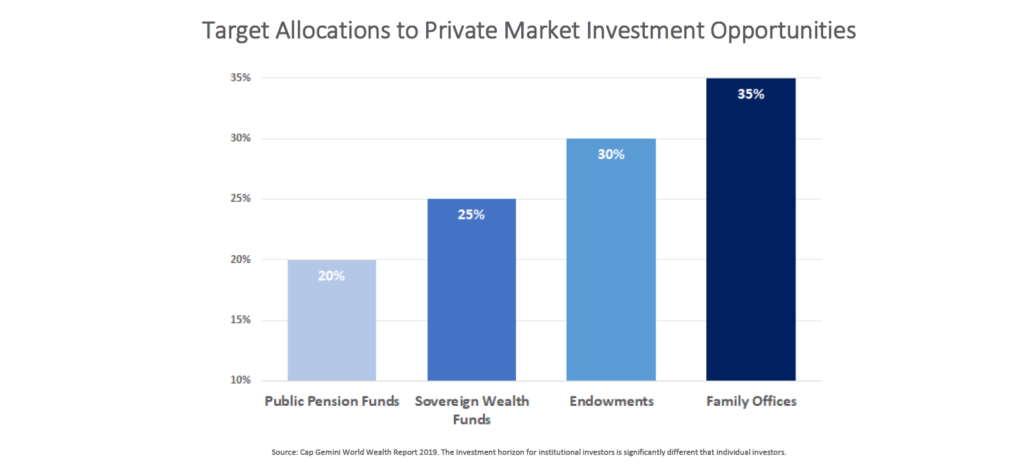

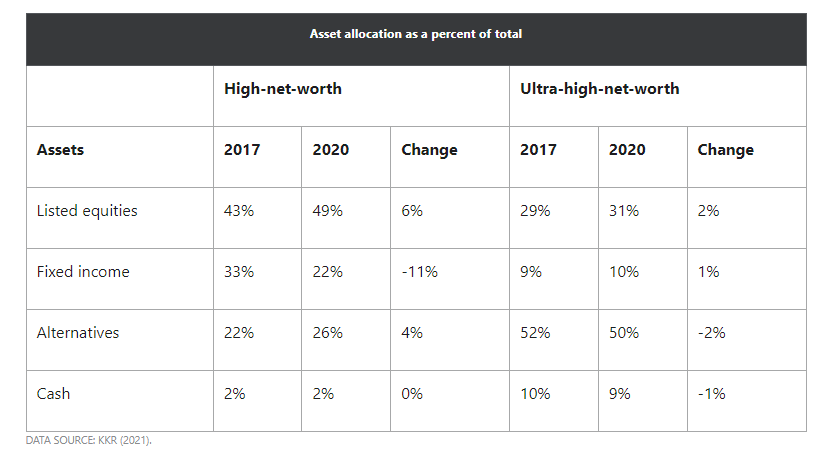

How much should one allocate to alternative investments?

I typically recommend a 20% to 35% allocation to alternative investments. These amounts are commonly found by pension funds, family offices, and high net worth investors. With that said, the amount you allocate should be based on what’s suitable for your situation.

How do I invest in alternatives?

Fund offerings have grown by leaps and bounds over the past several years. They are available for both accredited and non-accredited investors with very reasonable minimums.

While many companies offer alternatives direct to consumers, one must be careful as many are new and unproven. I can tell you from first-hand experience that I have lost money investing with these newer companies – especially in the crowdfunding arena. It is for this reason I strongly recommend working with a financial advisor to implement this strategy for a few reasons:

- Many funds are only available through advisors

- To help narrow down the choices

- To perform due diligence on these offerings on your behalf

- Minimums can be lower through an advisor

- Because manager selection is crucial

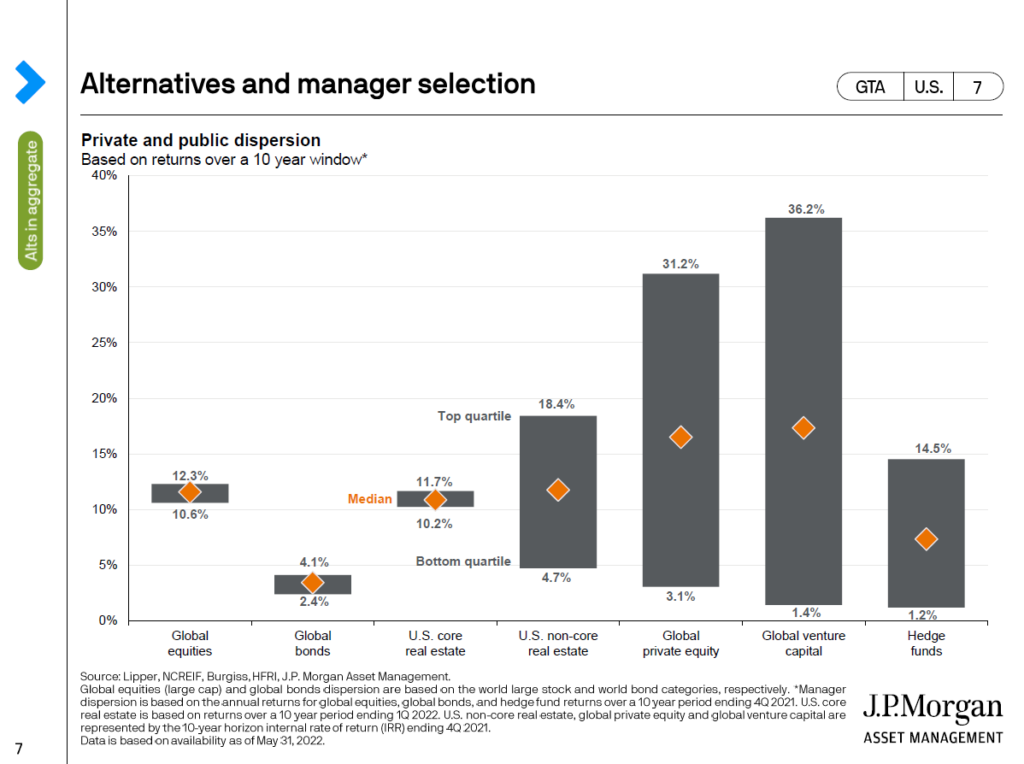

Manager selection

In the alternative universe, choosing the right manager is very important as the performance can vary widely between a great manager and a sub-par one. Advisors can help in this regard, so don’t go at it alone!

What are other considerations before investing?

Please bear in mind that alternatives are less liquid instruments compared to traditional investments. Capital can be locked up for years in these structures, so consider this before determining an allocation.

However, there are positives to this lack of liquidity.

The first is that these investments may earn a liquidity premium; the extra return investors demand to tie up their money. The second is that since funds are less liquid, you don’t see the same kind of panic selling commonly found in public markets, which helps reduce portfolio volatility. Lastly, many of the offerings I have approved to use for clients provide quarterly liquidity, which isn’t so terrible for long-term investments.

In conclusion, I am a firm believer that clients should be allocating a piece of their portfolio to alternative investments. It’s an exciting time for investors as these investments have become democratized for retail investors. I have spent the last few months writing on these strategies in detail and have learned much. I hope you have learned a lot too!

Sources & For Further Reading

Baird – The Role of Alternative Investments in a Diversified Investment Portfolio

CAIS – What Are Alternatives?

JP Morgan Guide To Alternatives

Motley Fool – 81%

Nuveen – Private Real Assets

Pension & Investments: Assets in Alternative Investments Set Record in 2020

WealthPlan Newsletter Archive

Dave’s Picks

Here is my YouTube vid o’ the month!

Here is my track o’ the month!

Here is my read o’ the month!

Referral Request

Since 2004, I have made myself available to act as a sounding board for anyone who may need urgent financial advice – or just a second opinion. In that time, I’ve been able to help over 100 families. As a result, our business comes primarily through introductions. So, if you’re approached by a friend, neighbor, or family member; please let them know that I’ll always find the time to listen; and will do our best to help. I firmly believe in doing well by doing good.