“It is not credible to allow an entire generation of retail investors to be left with only diversified public market exposure to generate retirement returns while institutional investors crowd into innovative business models [through the private markets] that offer potentially higher returns.” -CFA Institute

Dear First Mates,

Howdy, everyone! I’d like to continue my discussion of different alternative investments. Last month was real estate. This month – private equity. This asset class may be new to you, so I hope you enjoy this month’s read.

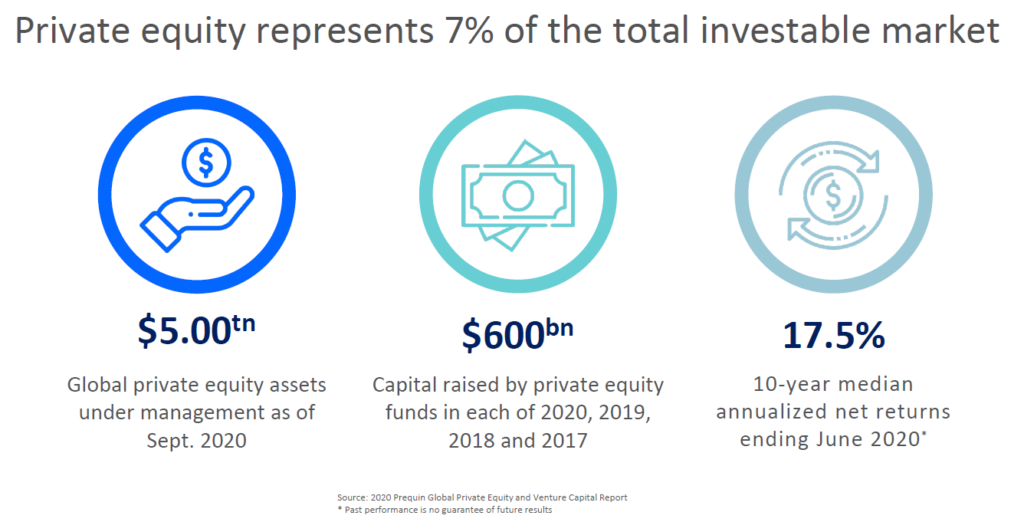

Private equity is an alternative asset class where investors allocate capital to private businesses not listed on a public exchange. Private equity is a $5 trillion market – definitely nothing to sneeze at!

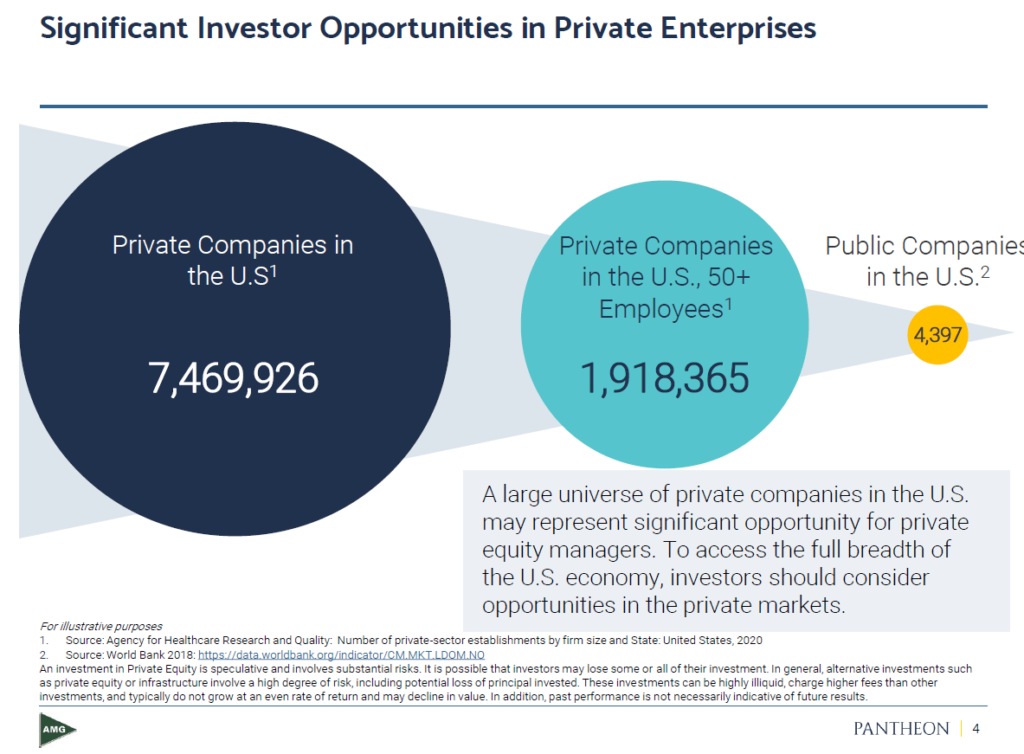

The vast majority of U.S businesses are private – 4,397 publicly companies versus 7 million private businesses. A huge difference!

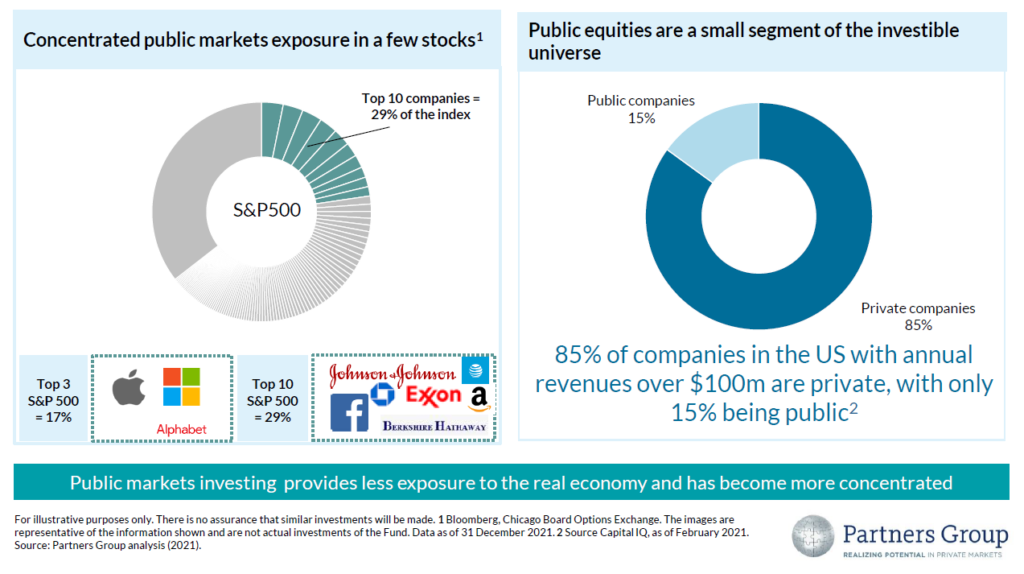

I have always advocated diversifying one’s portfolio. It is hard to do that when only 15% of the companies are open to investors!

The thesis for private equity as an investment is as follows:

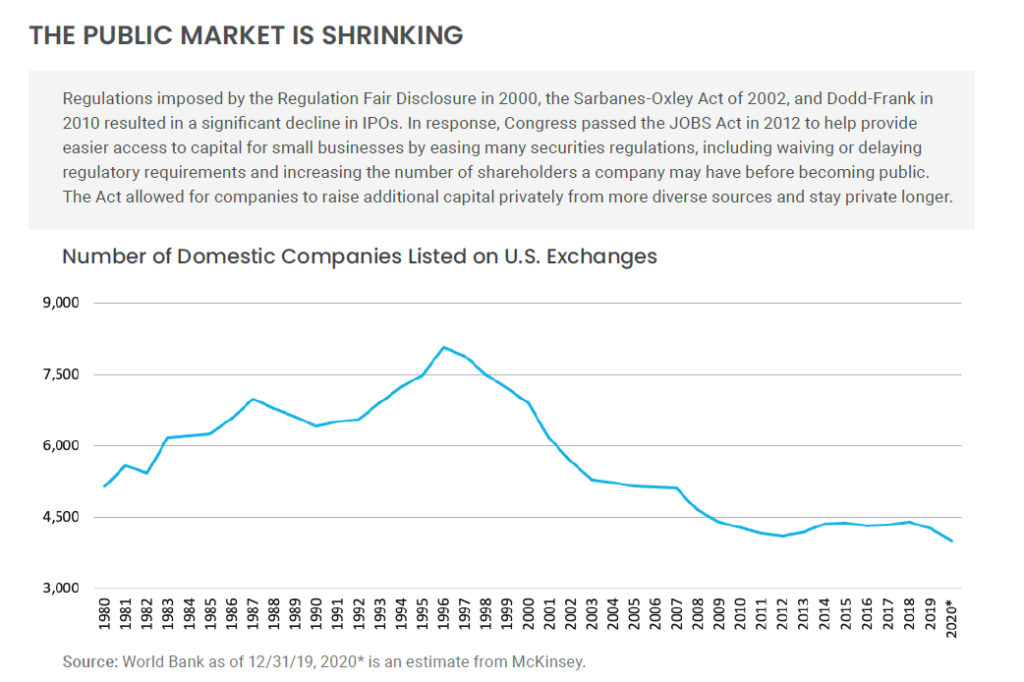

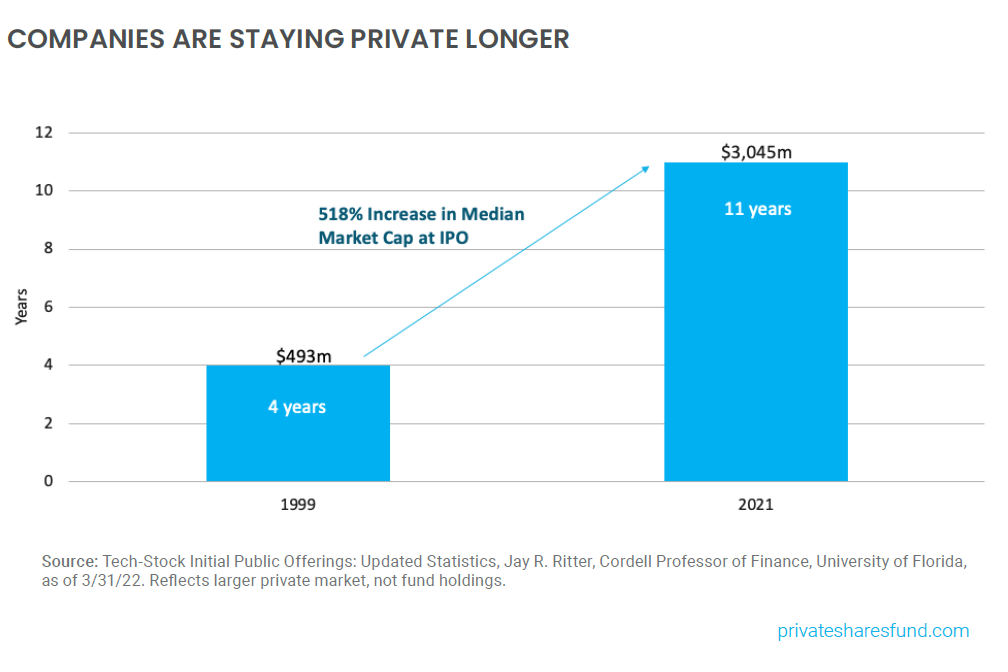

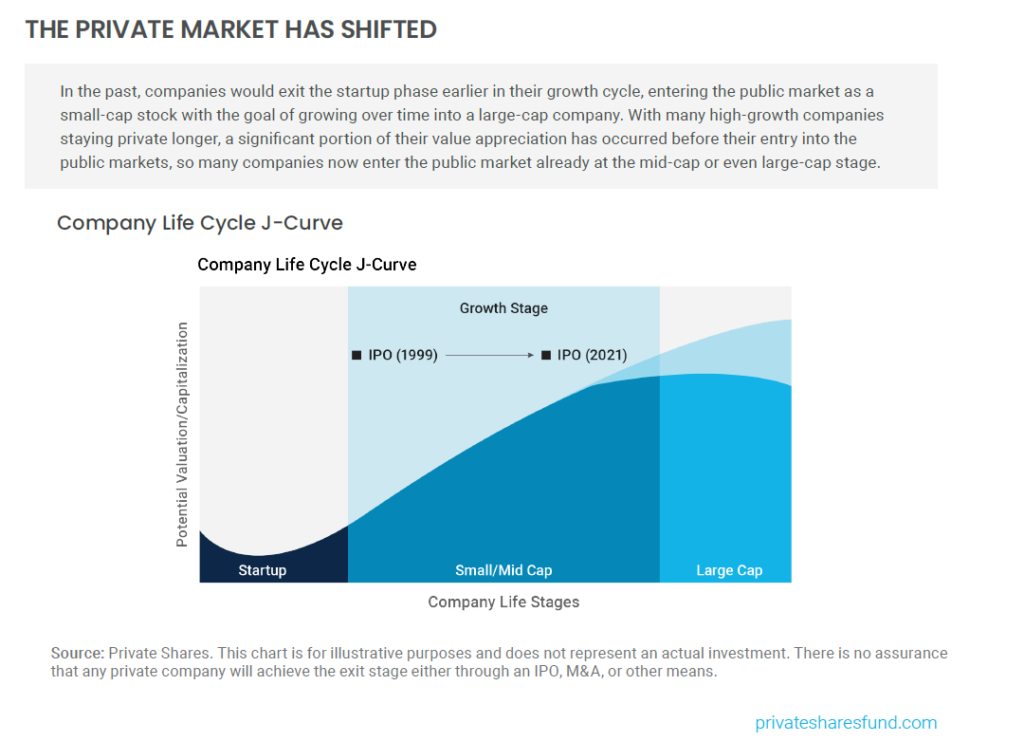

1) The public market is shrinking as companies are staying private longer

2. Improved diversification

3. The S&P 500 is becoming increasingly concentrated

Since only 15% of companies are open to investors, getting access to some of the other 85% increases diversification.

Currently, the top 10 companies in the S&P 500 represent 29% of the index. Getting more equity exposure may reduce volatility and improve future returns.

4. Value appreciation is occurring on the private side.

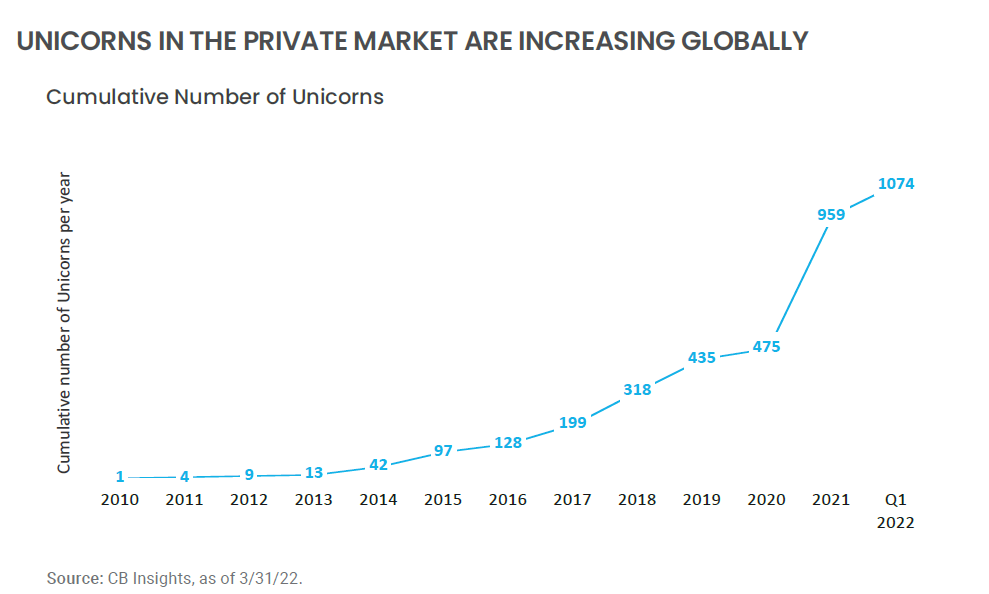

Since businesses are staying private longer, much wealth creation occurs outside the traditional capital markets. A unicorn is a private company worth over $1 billion. Over the last decade, the number of these unicorn companies has increased globally.

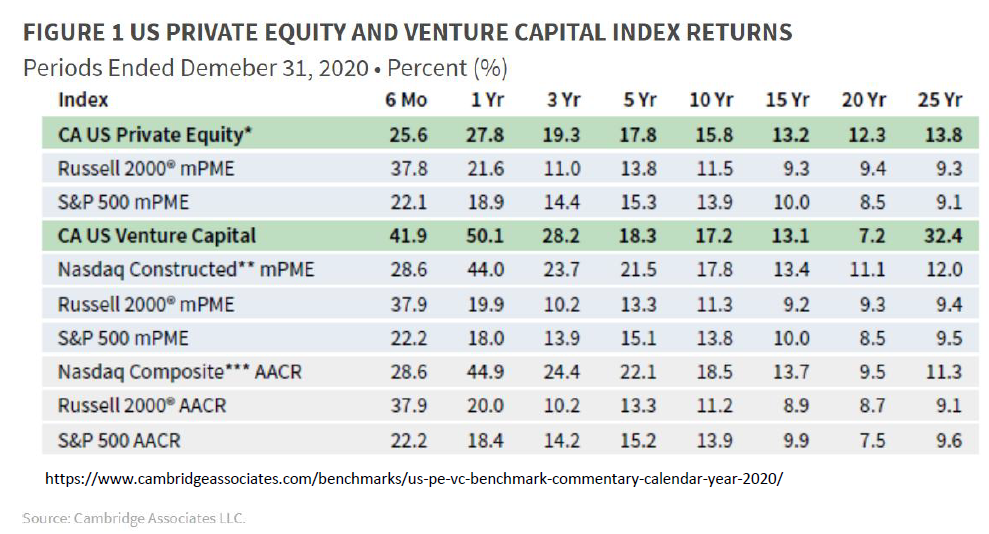

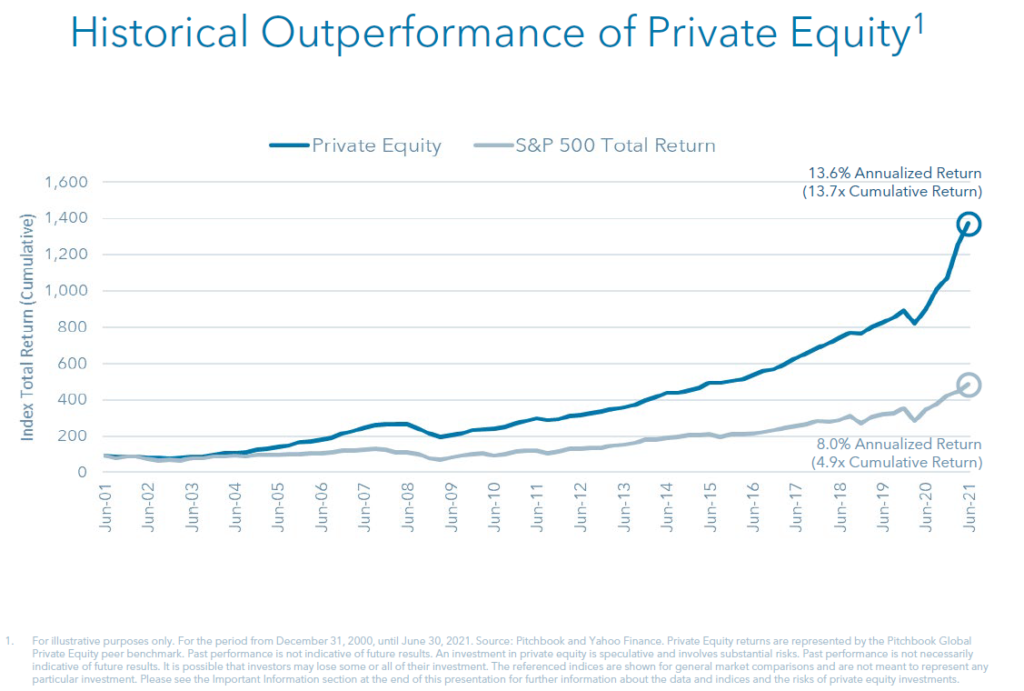

5. Strong historical performance

While historical returns don’t dictate the future, private equity as an asset class has looked very attractive in the past.

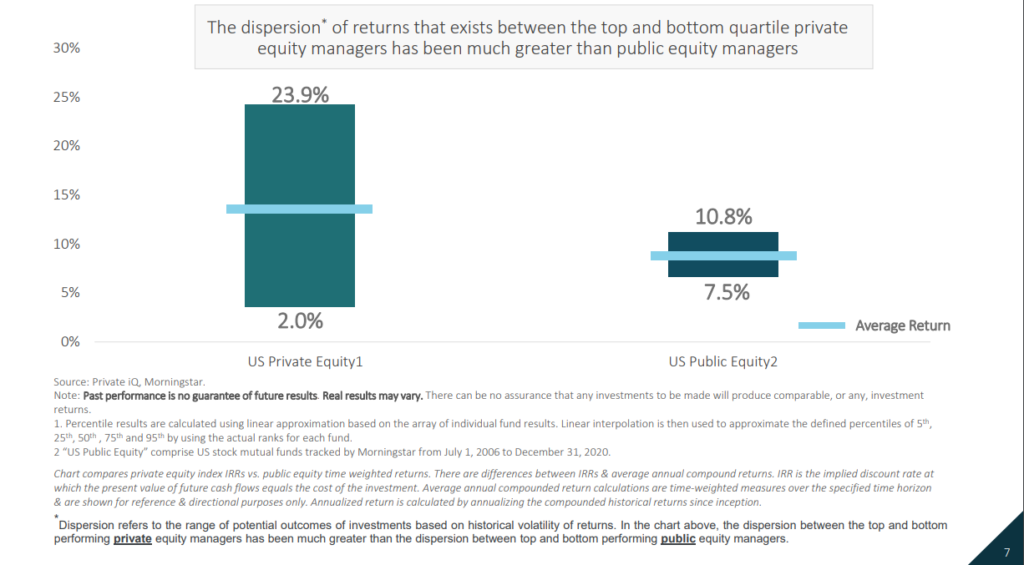

Choosing a strong private equity manager is extremely important as there is a massive gap in performance between the best and worst fund managers.

There are several private equity transaction types available to investors:

Direct:: A direct investment into the company

Primary: Investments in newly established private equity funds

Secondary: Investments in existing private equity funds

Co-Investments: A portfolio company invests alongside a private equity fund

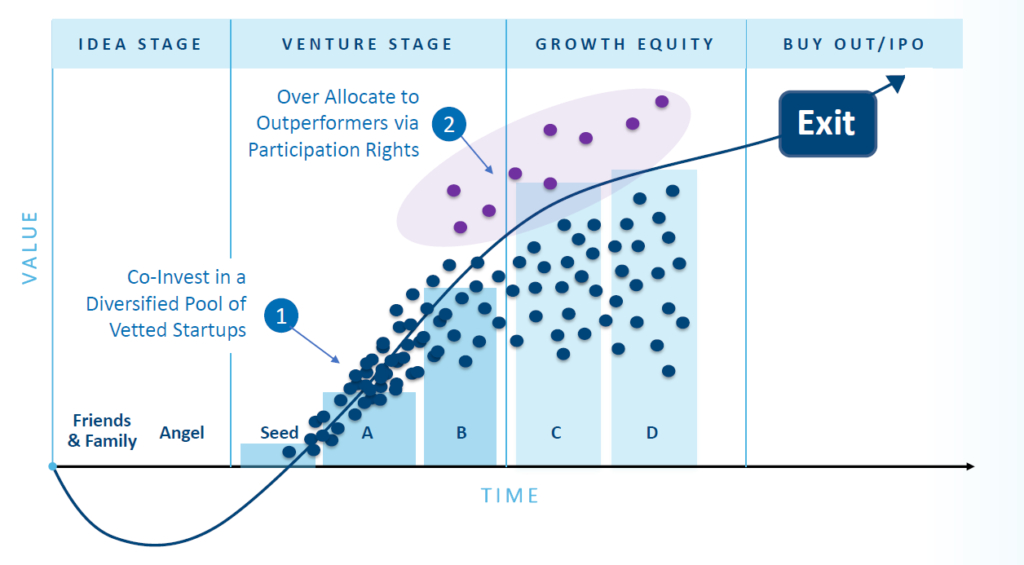

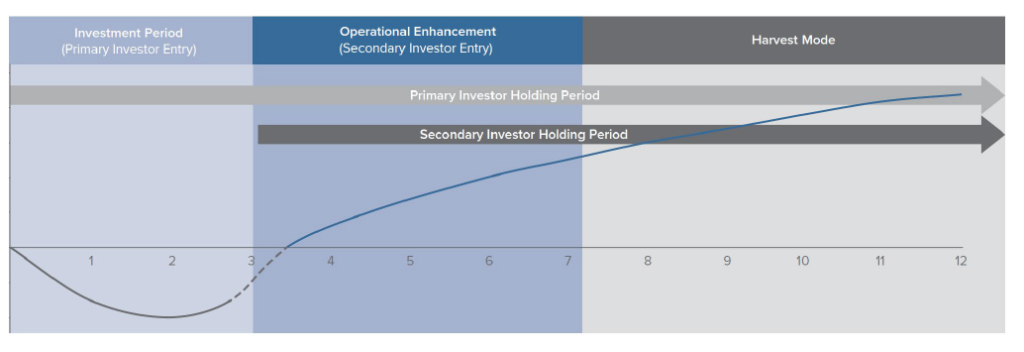

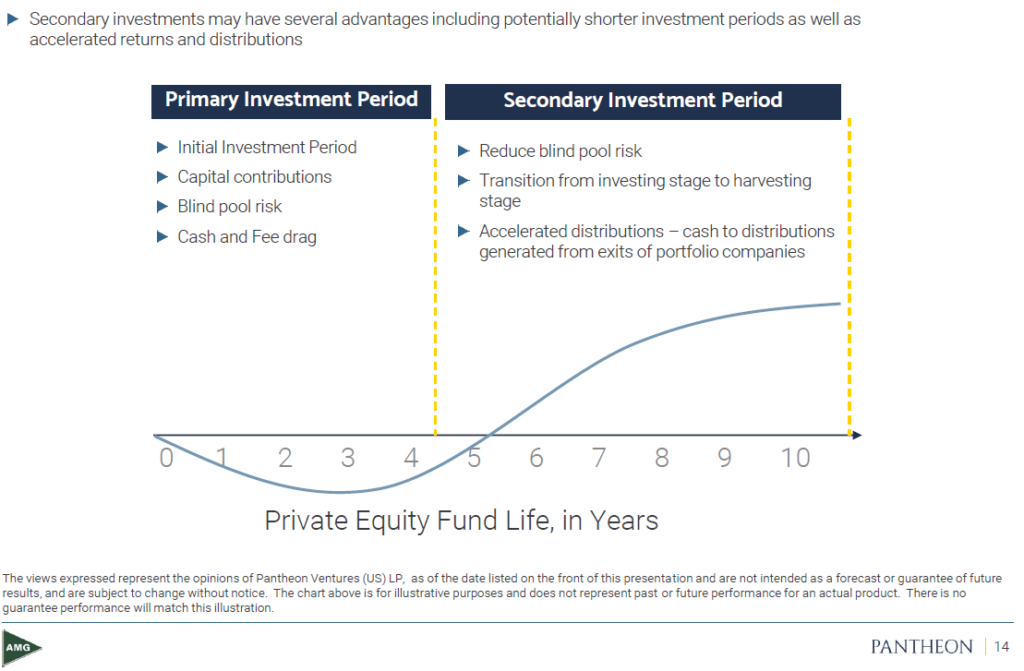

Secondaries can mitigate the “J curve” effect by investing in mature companies that may be closer to an exit. New companies require a lot of cash to rev up with the hopes of being profitable. The disadvantage is that your returns may be lower than had been invested earlier. More risk, more return!

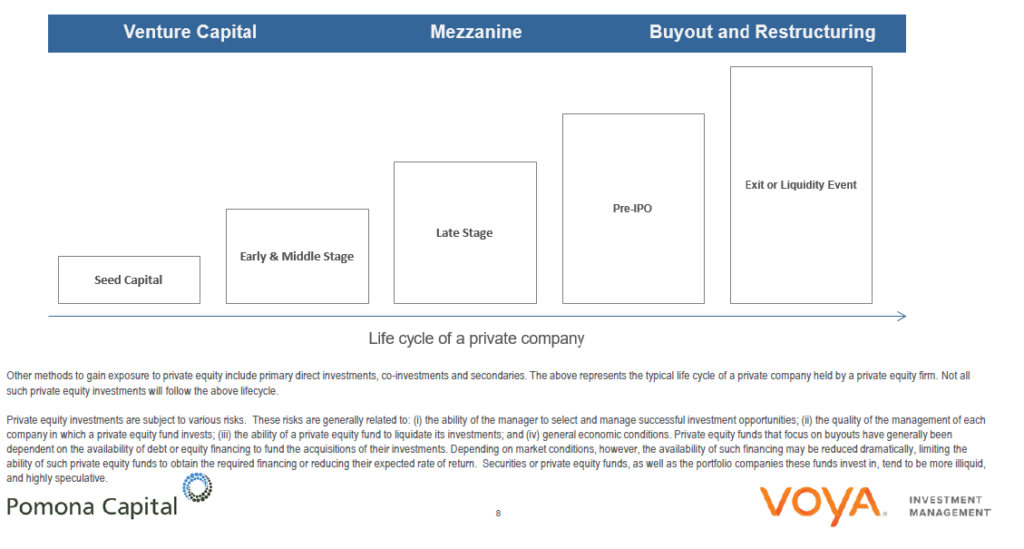

There are many stages of investment during a company’s lifecycle. Some strategies include:

- Leveraged buyouts: Involves buying a company completely to improve it to resell for a profit or via IPO. This is one of the most popular private equity strategies.

- Growth Equity; Investments in later-stage pre-IPO companies

- Venture Capital: Investments in new companies from initial concept to sale or IPO

I recommend watching the hit-show Shark Tank on ABC for an entertaining demonstration of venture capital.

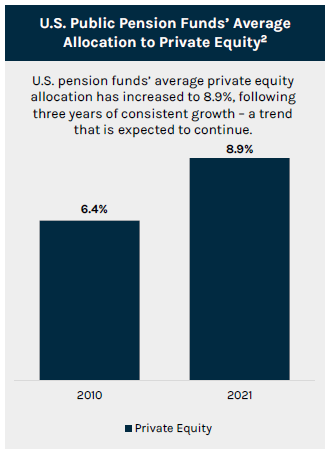

How much should one invest in private equity? While the amount will vary from investor to investor, I typically think 10% of one’s portfolio is suitable as it aligns with the allocation we see on the institutional side.

In conclusion, today’s thesis for investing in private equity is quite strong. There are a myriad of solutions to help clients get exposure to this exciting asset class. These solutions also overcome many of the challenges of private equity investing, including capital calls, long lockups, high qualifications, and high minimums. If you’d like to implement private equity in your portfolio, don’t hesitate to schedule some time with me.

For further reading

Blackrock – Private Equity

Investopedia – Private Equity

Investopedia – Understanding Private Equity

Prequin – Private Equity & Venture Capital

Vanguard – The Case For Private Equity

Dave’s Picks

Honest Trailers | Goodfellas

Never Enough – Loren Allred Live

The 3 Equations for a Happy Life, Even During a Pandemic (The Atlantic)