“Any time a country transitioned to a fiat currency, they collapsed. That’s just world history; you don’t have to know about cryptocurrency to know that.” – Nipsey Hussle

Dear First Mates,

Welcome to the third and final chapter in our cryptocurrency series. This newsletter aims to review key risks, provide an investment rationale for Bitcoin and Ethereum, and explain how to implement a crypto strategy. In short, this issue will be both practical and actionable. But first, let’s go back to 2013 so I can tell you about my crypto journey.

I first invested in cryptocurrency in 2013. I learned about Bitcoin from a podcast and was immediately hypnotized by the idea of “money” outside the confines of government. I wanted in. With $5,000, I remember thinking this would probably be a losing strategy and that I am a special kind of schmuck for investing. One year later, the market dropped by around 80% after a popular exchange called Mt. Gox collapsed, confirming I am definitely a schmuck.

Alas, not wanting to be hypocritical, I bought more Bitcoin because this is my advice to clients. I then bought more the year after that. Since then, I have read a lot on this subject—especially in 2017 and 2020, when Bitcoin was on fire. Ultimately, the lesson I learned was this: To earn outsized returns, an investor must be non-consensus and right.

Risks

While there are many risks with investing in crypto, in my opinion, these are the most prominent risks to be aware of:

- Hacks: A large exchange getting hacked could result in stolen funds that send shockwaves in the market.

- Technological: History has taught us that technologies come and go (public telephones, VHS).

- Regulatory: The fear of changing laws and regulations looms large in the crypto market.

A network effect is when a product becomes more valuable as more people use it. Since blockchains ultimately organize people, the more people using the network results, the more utility it may provide as a service. A crypto project that can’t create a network faces a greater risk of failing. The network effect should not be taken lightly, as evidenced by the Facebook purchase of a money-losing WhatsApp back in 2014 for an astonishing $19.6 billion.

Other risks include market, fraud, competition, and business risks. Due to these factors, many cryptocurrencies have failed. Philosophically, many people may choose the security blanket that centralized systems such as governments and companies provide over the decentralized blockchain system. Be prepared for a lot of fear, uncertainty, and doubt (“FUD”) once you enter the crypto community.

The bottom line is that investors should expect to see 80%+ drawdowns in this asset class, with the possibility of losing their entire investment. As such, only invest what you can afford to lose! One silver lining of investing in cryptocurrencies is that your stomach for handling everyday stock market volatility will be much greater!

Investment Thesis

Since Bitcoin’s inception, cryptocurrencies have emerged as an alternative asset class with exceptional returns. We begin with a fundamental economic concept: supply and demand. Price is determined by how much of something is available (i.e., supply) and how much people want or need it (i.e., demand). In the world of cryptocurrency, tokenomics refers to understanding cryptocurrency’s supply and demand characteristics. According to the scarcity principle, the price of a good, which has low supply and high demand, rises to meet the expected demand.

While we know the supply of many cryptocurrencies like Bitcoin and Ethereum, we do not know the future demand. Therefore, it is vital to research each cryptocurrency under consideration to understand its respective investment merit. As I write, Bitcoin represents around 65% of the crypto market and Ethereum around 28%. Therefore, I will focus on the investment thesis of these two large coins.

Bitcoin (BTC)

We know Bitcoin’s supply will be limited to 21 million coins by 2140. This scarce supply will shrink every four years due to the Bitcoin halving protocol, which controls inflation. But where is this demand coming from? While opinions differ, many investors view BTC as digital gold offering a non-sovereign value store. Assets like Bitcoin are scarce, fungible, divisible, non-decaying, and can be transported across borders seamlessly.

Some investors see Bitcoin as a growth investment. Others use it as an alternative investment to help diversify their capital markets portfolio. My view is that our rising national debt, stunning 40% money supply increase, and strong institutional interest have helped push Bitcoin to its current levels. Ultimately, Bitcoin (like gold) is a fundamental hedge against bad government policy. Some insist that we could one day see Bitcoin emerge as a one-world currency. Let’s hope the government does not steal our Bitcoins as they did with our gold in the ’30s! It may be that other coins will replace Bitcoin as the store of value mantle or that the market will never materialize. Still, if it does succeed, even just a tad, it’s potentially significant.

Bitcoin Valuation

Price predictions for the OG crypto vary wildly. While some use Metcalfe’s law to value it, I prefer a simple calculation of {demand ÷ supply}. If we assume $5 trillion enters BTC over time as more people trust it, you will get a price of $238,000 USD {$5 trillion ÷ 21 million}. Looking at the world’s money, this sounds feasible when there is currently $95 trillion in cash, $89 trillion in the global stock market, and $11 trillion in gold.

Ethereum

Ether is the token that facilitates operations on the Ethereum network. The main reason to invest in Ethereum is its potential to reinvent financial services. Ethereum and its competitors threaten to disrupt every part of the traditional financial services ecosystem. It can do this because it can process transactions without a trusted third party and create “programmable money” that combines value transfer with software.

The Ethereum blockchain possesses this real-world utility through its smart contracts and DApps. As Ethereum powers more real-world applications, there will likely be an increasing demand for Ethereum to make the applications run. While Ethereum does have competition, it is the most well-known and should hopefully benefit from a network effect. The future looks promising as companies like Amazon, JP Morgan, Microsoft, and DocuSign are already building on the Ethereum blockchain.

Crypto Implementation – How much crypto should I own?

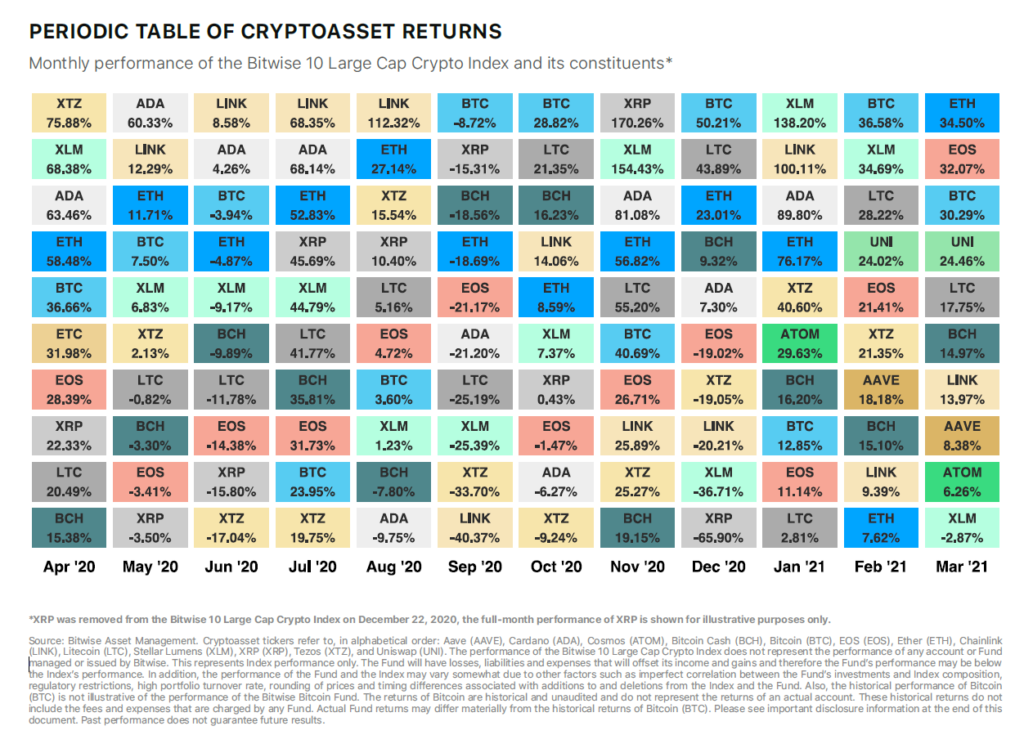

While many views exist on the matter, I think a 1% to 5% allocation to digital assets is suitable as part of one’s diversified portfolio. While owning Bitcoin and Ethereum is a good start, returns can vary significantly, and the asset class is still in its infancy. As such, I feel owning a diversified basket of the leading cryptocurrencies through an index is an ideal strategy.

Here are some of the most popular ways to invest in cryptocurrency today:

1) Invest in the coins you like on a crypto exchange (e.g., Coinbase, Gemini, Voyager)

2) Invest in private placements aimed at accredited investors (e.g., Bitwise, Grayscale, Osprey)

3) Invest in publicly traded crypto securities (e.g., Bitwise, Grayscale, Osprey)

4) Invest in publicly traded companies or ETFs serving the blockchain and crypto ecosystem

5) Invest with crypto solutions provided by your financial advisor (Arbor Digital, Willow Crypto, Blockchange)

6) While not out yet, there is currently a race to launch a Bitcoin ETF pending SEC approval

I feel we are living in a time where we have begun to lose trust in our most cherished institutions. These institutions include our government, elected officials, media, financial systems (think GameStop), the CDC, and corporations (especially Social Media conglomerates). Cryptocurrencies may be able to restore that lost trust through the math and computer code of blockchain technologies. Marc Andreessen famously said that “software is eating the world.” The end result will be the democratization of money, which will give more power to the masses. This leaves me with a lot of hope for the future.

In summary, the digital asset space, whether cryptocurrencies, asset tokenization, NFTs, or DeFi, is an exciting asset class with great potential. I hope I have made a complicated subject a bit more understandable. I would encourage you to read the embedded hyperlinks, as these were included to fill in the blanks in my thinking. I find that the more knowledge in this arena, the more likely one is to invest in its future. Once you invest, be prepared to HODL on for dear life! To learn more about incorporating crypto in your portfolio, please do not hesitate to ask!

Research

Why I Invested in Bitcoin and Ethereum

Modeling Bitcoin Value with Scarcity

Why Crypto Crosses ‘The Chasm’ in a Post-Coronavirus World

Dave’s Picks

Bruno Mars, Anderson .Paak, Silk Sonic – Leave the Door Open [Official Video]

An Illustrated Glossary of Cryptocurrency Slang (Infographic)

WatchMojo.com (great YouTube channel)