“Advisors can create the best portfolios in the world, but they won’t really matter if the clients don’t stay in them.” – Harry Markowitz

Dear First Mates,

Hello everyone! I hope you are all doing wonderfully. With the market drawing down this year, many investors feel scared, uncertain, and worried about the future. So – this piece is the third entry of my philosophical ramblings. Before continuing, please read the “First Principles” as well as the “On Risk” pieces.

Here is my central thesis as it pertains to this newsletter:

Investing in a diversified basket of mainstream equities is a conservative method of building wealth over the long term.

There are, indeed, many speculative investment options out there that can result in a loss of all or part of your principal. These can include starting your own business, owning concentrated stocks and real estate, and investing in cryptocurrency.

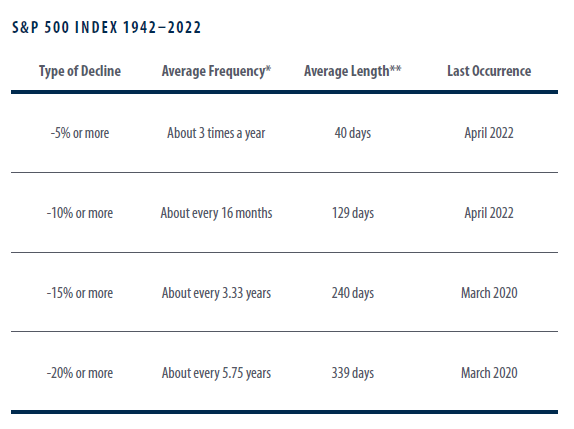

Investing in mainstream equities couldn’t be more different. Let’s start with the negatives. We know from history that the market will randomly and unpredictably go down.

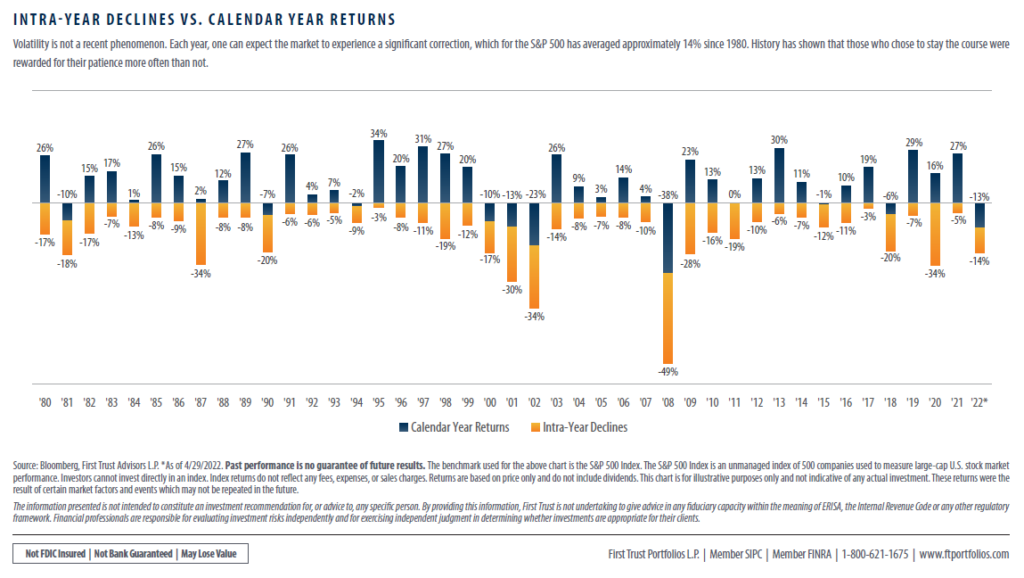

So expect your investment to drop around 14% every year.

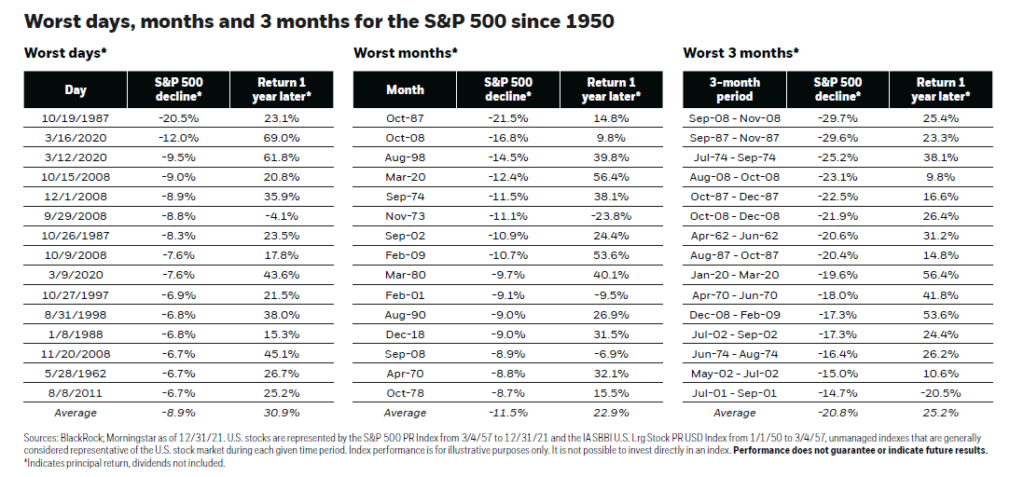

And these temporary pullbacks can’t be forecast or timed with any precision.

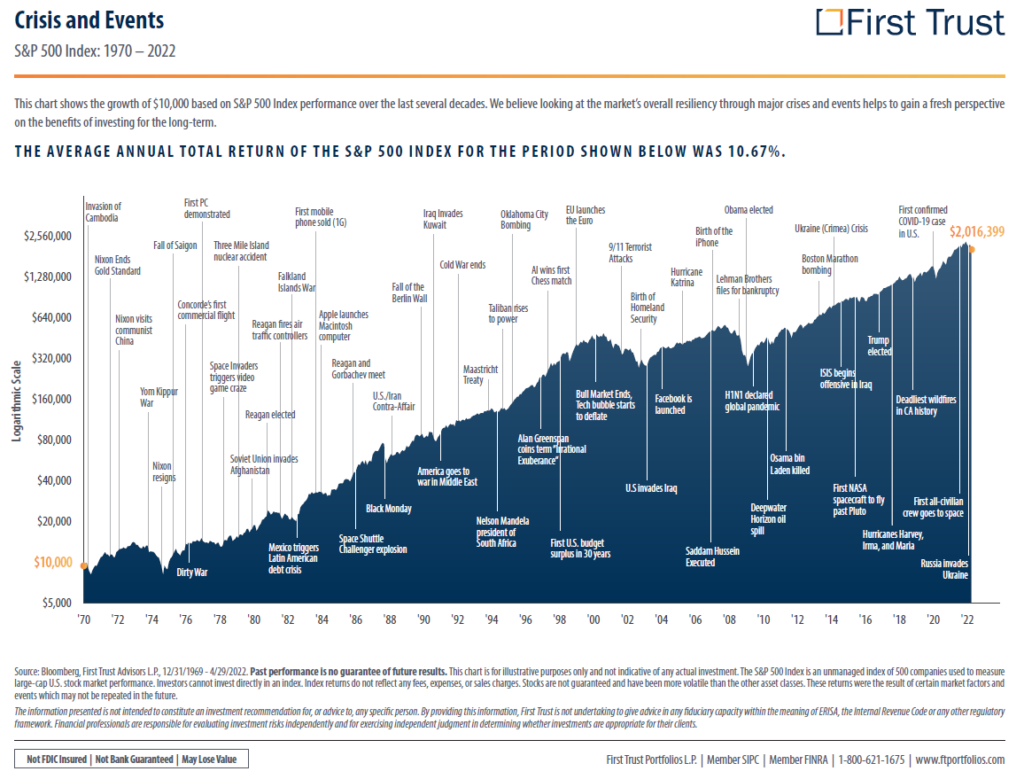

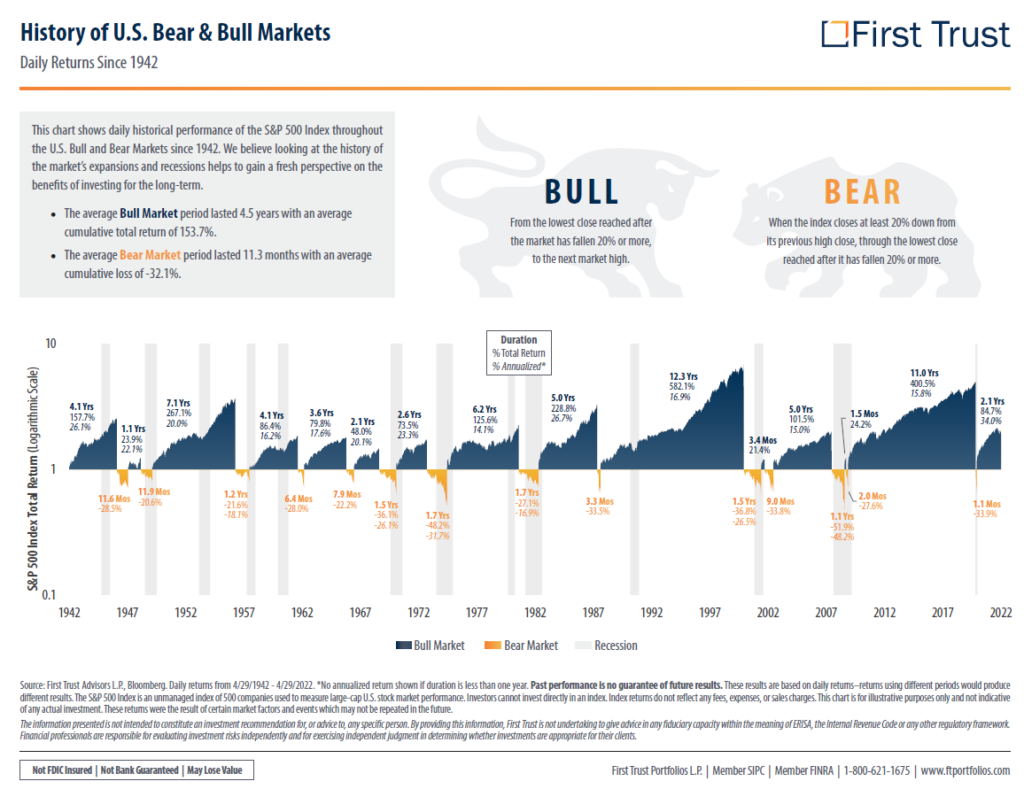

We’ve seen endless crises, wars, and economic recessions. Yet the market is resilient and climbs higher and higher.

The average bear market period lasted around 11 months, with an average cumulative loss of -32.1%. Ouch!

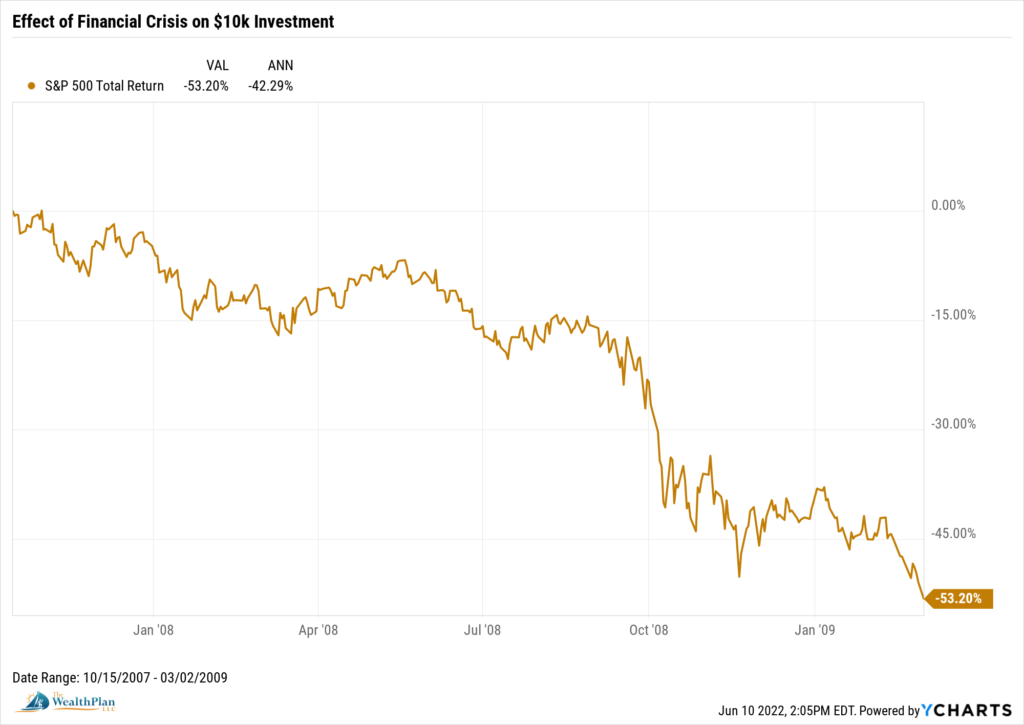

Prepare to experience 30% drawdowns every few years. During the financial crisis of 2008 – investors temporarily suffered a 53% drawdown. But eventually, the market recovered.

Like it always has.

As if investing wasn’t hard enough – the media makes it more challenging. I’m convinced financial journalism thrives on spreading fear and ignorance, causing investors to sell their investments at the worst possible times.

BusinessWeek predicted the death of equities back in 1979. This was one of the worst predictions ever made – as the ’80s & 90’s experienced a tremendous bull market with a 7,000% gain starting in 1982. You read that right – 7,000%!!!

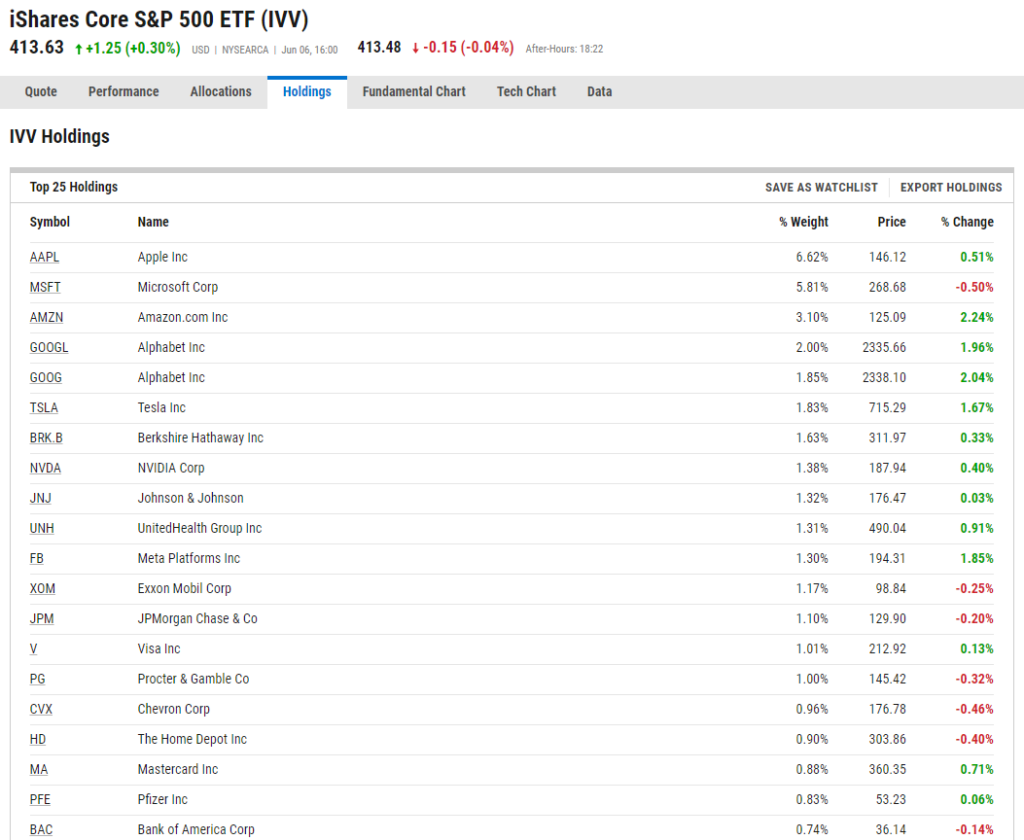

Ok, now let’s look at the bright side. These are the top companies currently found in the S&P 500.

These are the world’s most mature, biggest, and most loved names the world has ever seen. They are operated by the brightest individuals deeply committed to enriching people’s lives through their products and services.

Things would have to become very apocalyptic for these companies to not grow over our lifetimes. If these companies can’t rise over time, we have bigger problems than your portfolio balance. Like zombies. Or nuclear war. Or nuclear zombies.

And their job is to protect shareholder capital against bad government policy and the market itself.

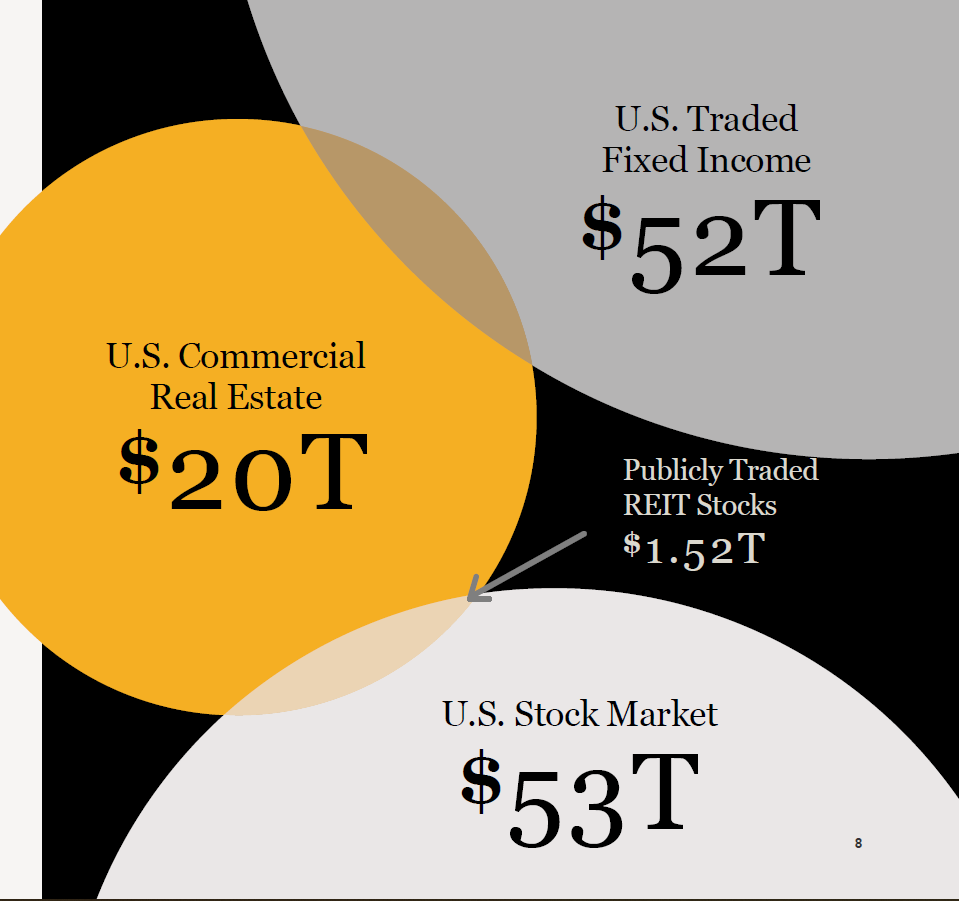

But it gets even better. The market is worth over $50 trillion- before you diversify in fixed income (bonds), commercial real estate, and private markets.*

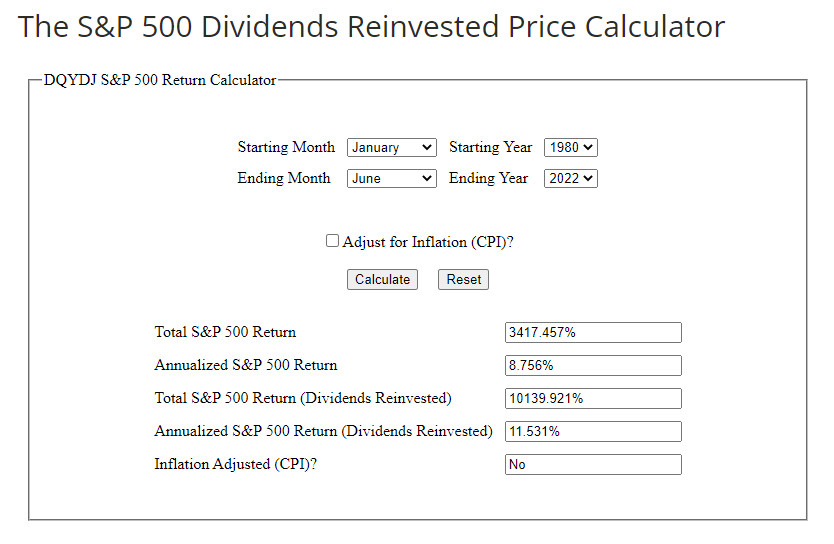

I’d encourage you to look at what the S&P 500 has grown over your lifetime with his nifty tool.

-If you were born in 1940 – it compounded at 10.90%

-If you were born in 1960 – it compounded at 10.07%

-If you were born in 1980 – it compounded at 11.53%

-If you were born in 2000 – it compounded at 6.51%

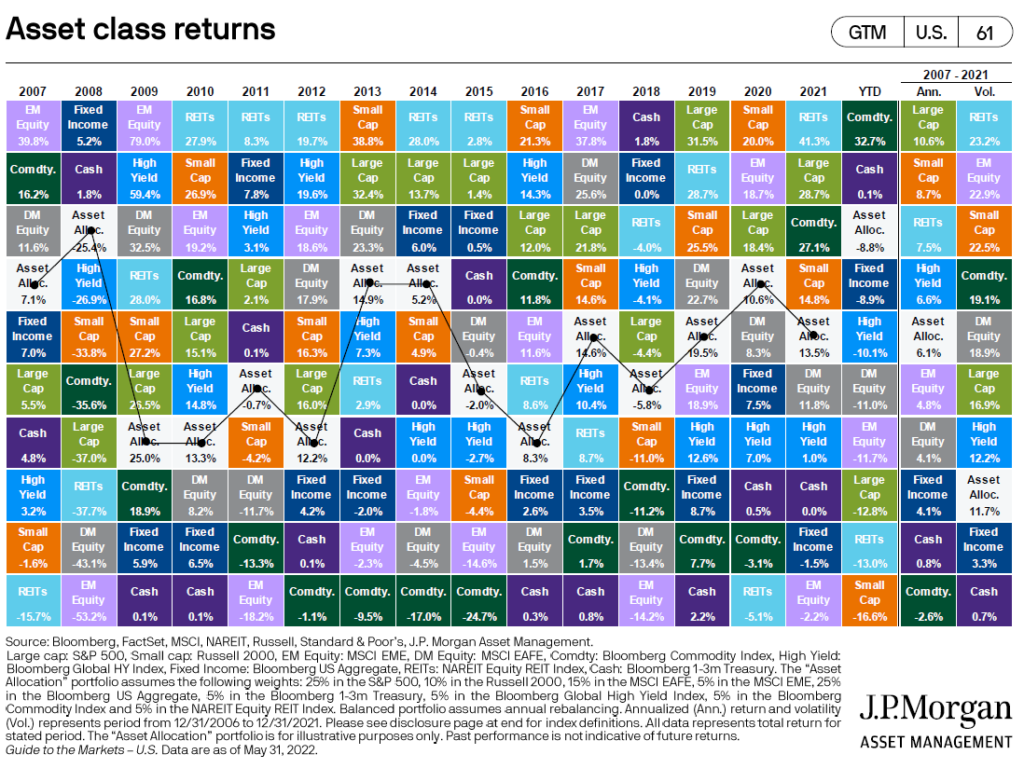

A diversified portfolio is much more than the S&P 500, though. It will consist of thousands of companies of different sizes across the globe via many distinct asset classes. For more on this topic, check out the “On The S&P 500” newsletter.

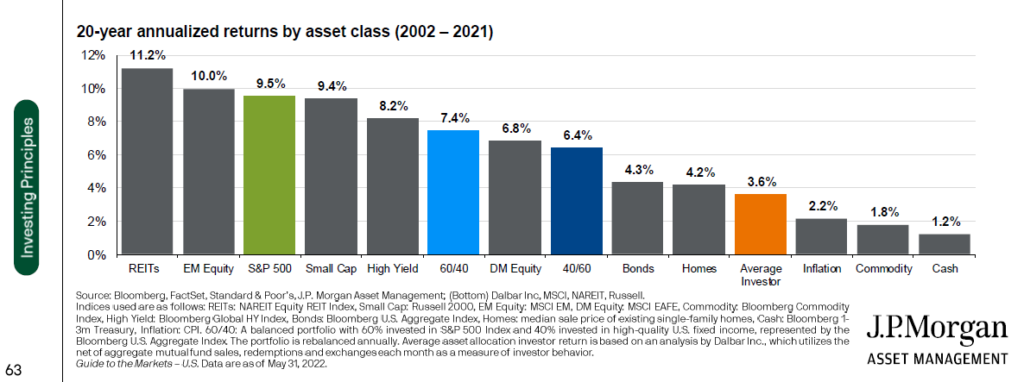

The best thing an investor can do is take the time to study history. Over the last 20 years, you can see how well stocks have done to protect you from inflation (and, frankly, how cash has failed in this endeavor).

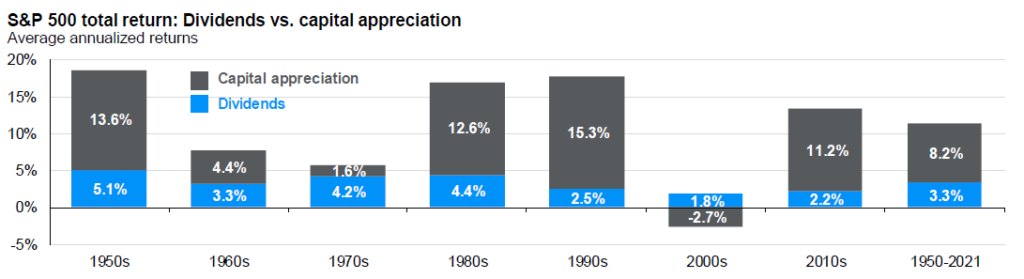

But what if this time is truly different? What if the markets are flat for the foreseeable future – like we saw in the 2000s.?

Enter dividends. A dividend is the distribution of corporate profits to eligible shareholders

to reward investors for putting their money into the venture.

Even ignoring capital appreciation, stock dividends have done an excellent job protecting our purchasing power.

Even in the 1970s – our country’s closest-ever-brush with hyperinflation – stock dividends protected investors’ capital.

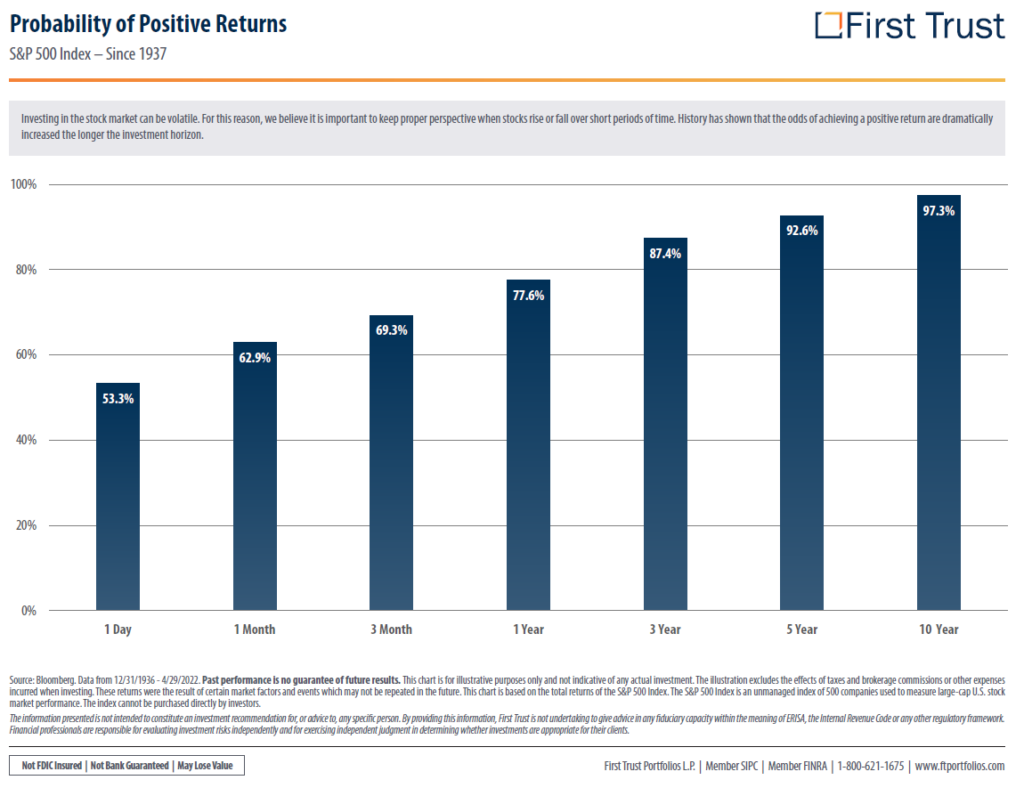

The power of mainstream equities is that, given enough time, the odds are incredibly high that you will grow your wealth. Over 95%!

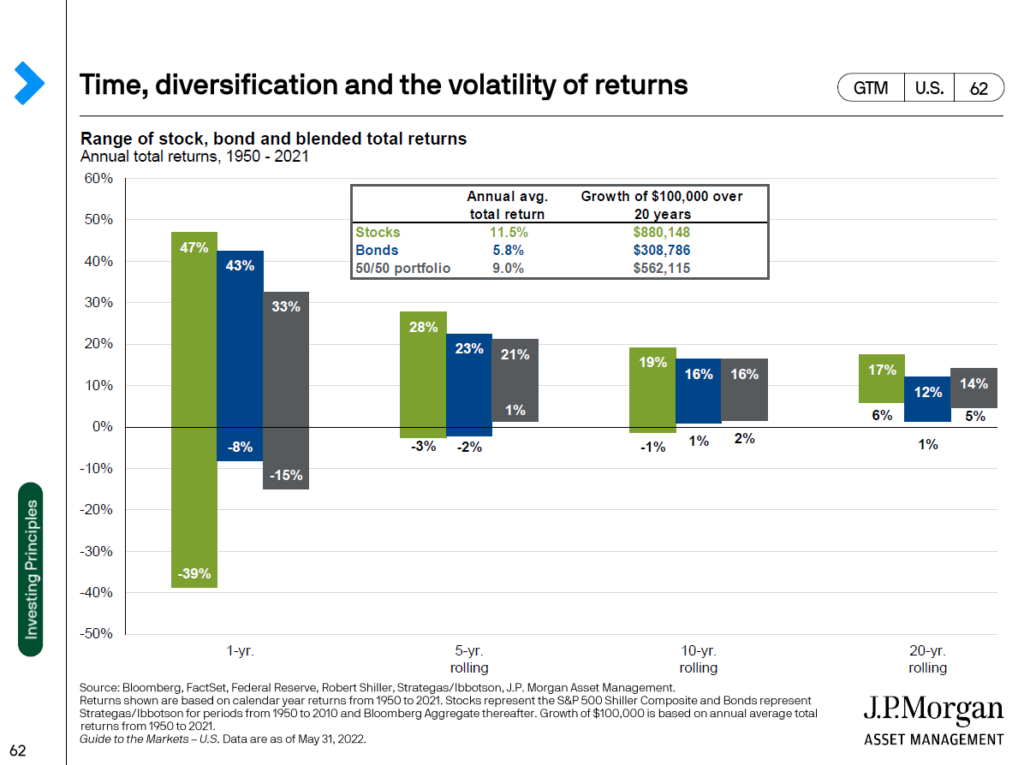

And while no one can predict the future, there was no 20-year rolling period where mainstream equities didn’t produce positive returns. Truly astounding!

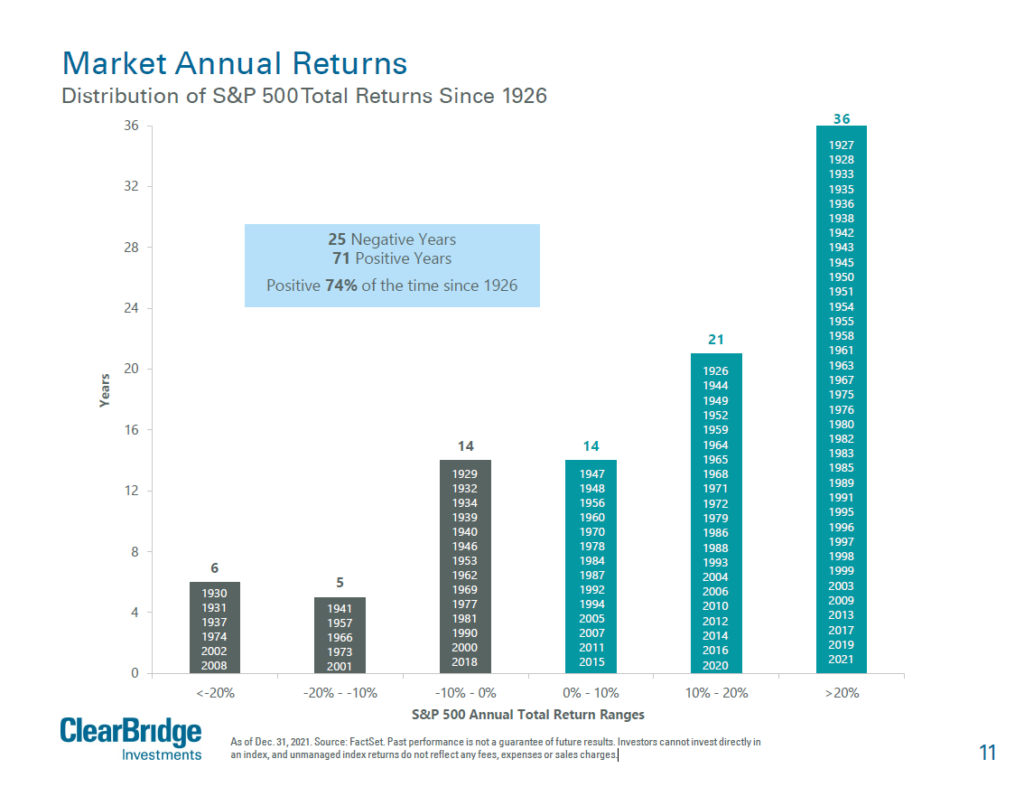

And, since 1926, we see the market has produced positive returns 74% of the time! So, history teaches us that stock investments have grown three out of every four years.

Your focus should be on achieving the financial goals found in your written plan. The year-to-year movements of your portfolio are irrelevant over one’s retirement.

The only risk that matters is your not achieving your cherished goals. Whatever they may be.

Here is our bear market action plan:

1) We hold our investments and never sell until we need the money

2) We diversify

3) We harvest losses for tax purposes

4) We continuously save and invest through good times and bad

5) We rebalance our portfolios to maintain our asset allocation

In conclusion, I can think of no safer investment than mainstream equities for one’s retirement. There are many speculative investments out there, but stocks are certainly not one of them. Cash is not king, but rather, a money loser after inflation is considered. Recessions, depressions, and pullbacks are woven into the investing fabric and should be expected. So please, stop worrying and enjoy your life!

Here is my YouTube Vid O’ The Month

Here is my Jam O’ The Month

Here is my Read O’ The Month

Here is a Tearjerker Vid O’ The Month

You can see my newsletter archive here.

Please see here and here for more data.

*Source: Federal Reserve, Bureau of Economic Analysis, NAREIT, SIFMA, World Bank, Economy.com and LaSalle Investment Management. Based on data through 2021.