“Diversification is the one free lunch of investing, and when you see a free lunch, the only rational thing to do is eat.” – Cliff Asness

Dear First Mates,

As 2021 is slowly fading away, I would like to wish each of you a happy holiday season. I love this time ofhttps://thewealthplan.box.com/s/n5y38dlyd1ngforrw2ehs4g0ieu8wsfz year as the beautiful lights and decorations fill me up with joy and optimism.

A common question I receive from clients on occasion goes something like this “Dave – my portfolio increased by [x]% this year, but the S&P did even better. Can we just invest in the S&P 500 going forward?” This is a fair question that deserves its own newsletter. So, here it is.

To clarify, I am going to answer two questions here:

1) Should we invest all monies in the S&P 500?

2) Should the S&P 500 be our primary performance benchmark?

Let me say at the outset that I’m a big fan of the S&P 500 and maintain a significant allocation there for clients, but, for both questions, my answer is an unequivocal NO.

Before we begin – What is the S&P 500?

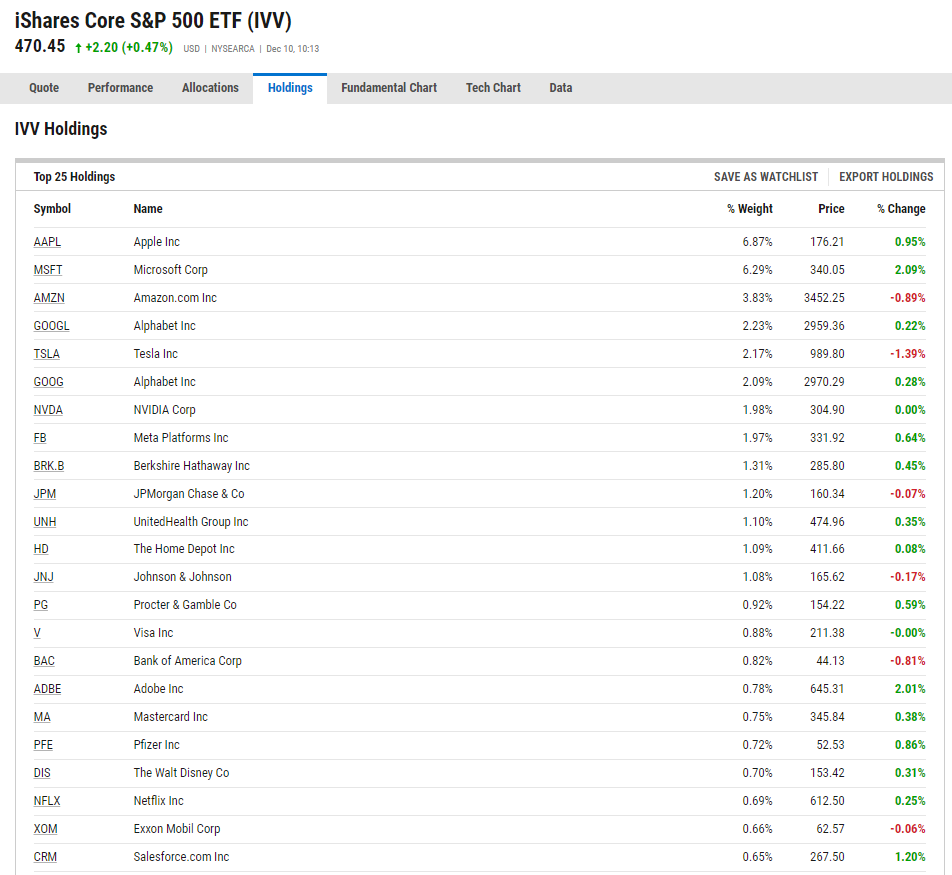

The S&P 500 is the most widely used and popular benchmark for how the U.S. stock market is performing. It refers to the Standard and Poor’s 500, which is a stock market index that tracks the performance of the 500 largest companies listed on stock exchanges in the United States. When looking at the top 25 holdings below, it’s no surprise why it’s so popular!

Should we invest our entire portfolio in the S&P 500?

No! Here are three reasons why.

1) Diversification is the name of the game.

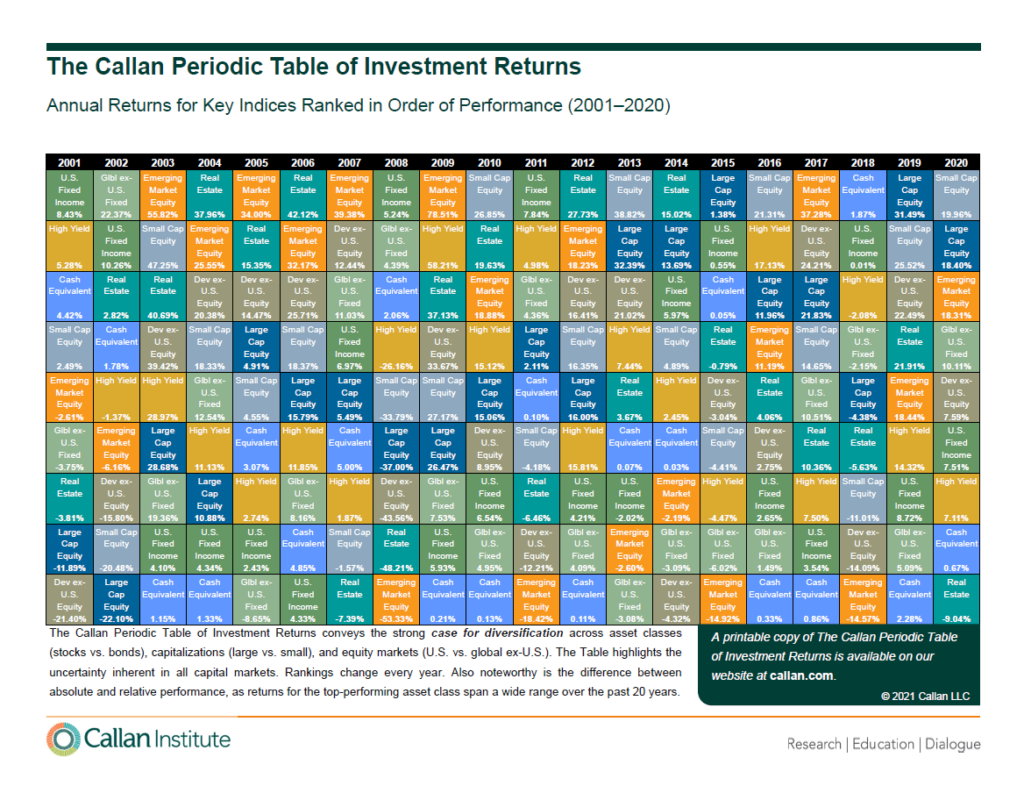

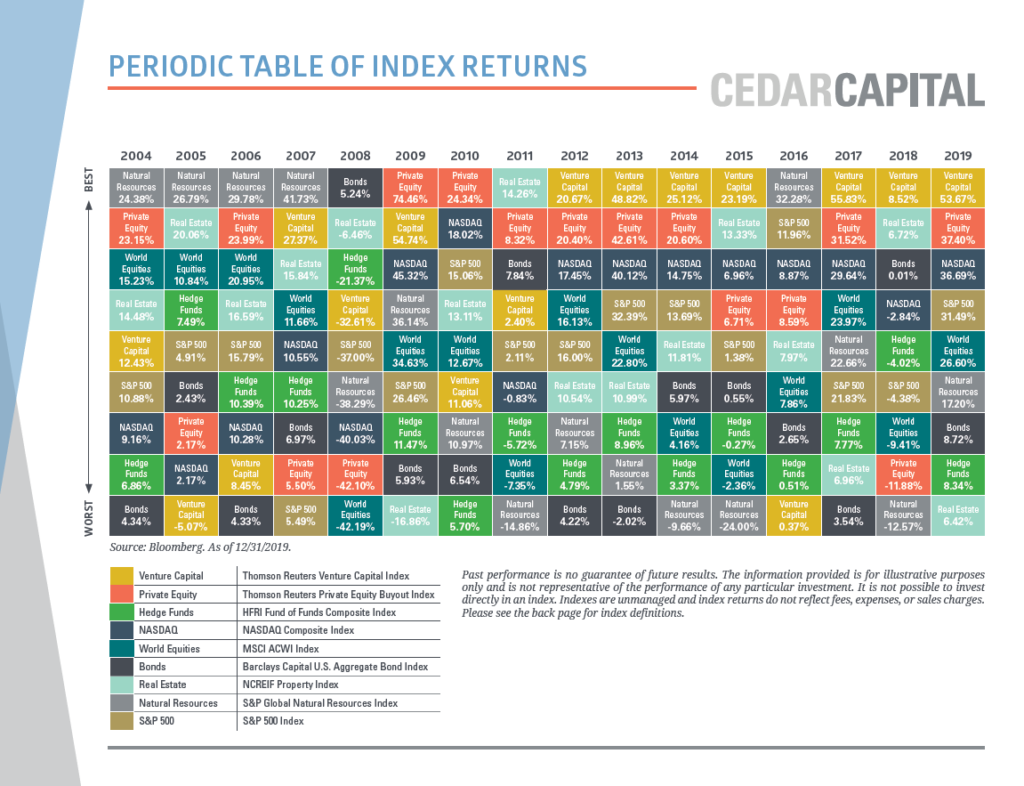

A diversified portfolio is comprised of many distinct stock and bond asset classes (i.e. categories). As you can see below, each year produces different winners and losers. Because of this, we do not want to eliminate categories that have the potential to outperform the S&P 500 in the future. Some asset classes include real estate, international companies, or smaller U.S. companies.

Furthermore, the investment universe offers much more than large U.S. companies – such as hedge funds, private markets, digital assets (cryptocurrency), and natural resources. The primary reason to hold alternative investments is to increase your return and lower your risk by having uncorrelated investments in your portfolio. By doing so, you may earn a higher expected return with lower volatility. Ultimately, diversification prevents you from making a killing so you never get killed.

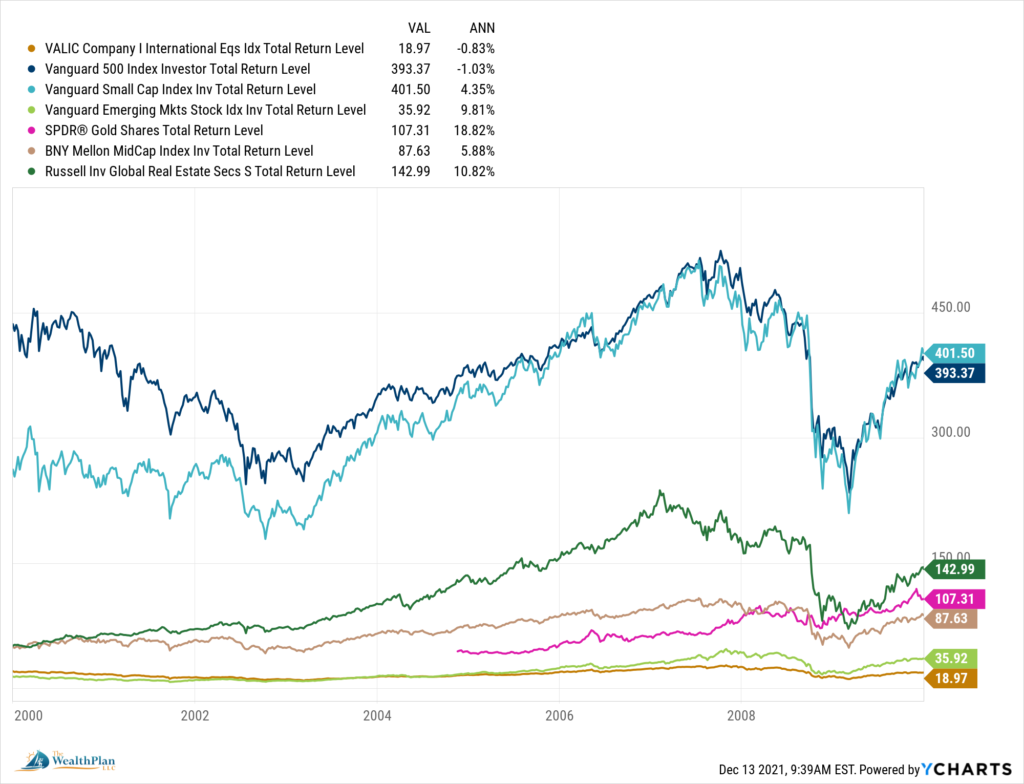

2) The S&P 500 can struggle for a long stretch of time.

As you can see in the image below, the 2000s was a very rough time for the S&P 500. The Dotcom Bubble, which started in 2001, was then followed by The Great Recession of 2008. The end result was the S&P 500 lost around 1% per year FOR A DECADE.. Fortunately, you can see in the image below how other asset classes produced positive returns over the same time period. A lost decade, pending on the allocation, became a positive one for those adequately diversified. Charlie Munger once said “the first rule of compounding: Never interrupt it unnecessarily.”

Some investors, not seeing portfolio growth during this time, gave up and sold their securities. Who can blame them? Their behavior is understandable given the power of loss aversion which states that the pain of losing $100 is often far greater than the joy gained in finding the same amount.

But that, my friends, is the BIG MISTAKE. As I always say, the wrong portfolio is the one you can’t stick with – FOEVER. The point I’m trying to drive home here is that if diversifying kept you in the market, that is all that matters. Fortunately, the 2010s saw the S&P 500 roar back (like it always has historically speaking) with the patient and disciplined amongst us being highly rewarded. Fortune favors the bold!

3) A very small number of stocks produce most of the returns over time.

I recently stumbled on research that demonstrates how, ironically, public markets and venture capital markets are not so different. What if those few companies that will drive returns over the next 20 years are not currently in the S&P 500? What if they are in other asset classes– like the ones we saw above – or don’t even exist yet?

Check out the fascinating research here, here, and here.

Is the S&P 500 a good benchmark for success?

Using the S&P 500 is an okay option for comparing, or benchmarking, your portfolio’s success. However, I think there are two better benchmarks to use. First, I’d use a benchmark that closely resembles your actual portfolio. My client portfolios serve as benchmarks themselves since they represent the global markets. Second, benchmark your portfolio with a return needed to acheive your financial goals. For example, I use a conservative return target (like 6%) in plans to minimize the chances of clients falling short.

In conclusion, investing strictly in the S&P 500 isn’t a wise move when looking at its history. It is not diversified, can underperform for a long time, and can miss out on tomorrow’s winning stocks. Ultimately, I fear it can lead to behavioral errors, which are everything in personal finance and investing. The S&P 500 has been on fire and is currently the red dot. However, I learned many years ago to never ever solely chase the red dot.

With gratitude,

David Warshaw, CFP®