Dear First Mates,

Hello there! I hope the final days of summer are going well. As I write, gold is approximately up a whopping 29% since the beginning of the year. So, this is a great time for me to share the pros and cons of the shiny metal with you all.

A Brief Gold History Lesson

1792 Bimetallic Standard: The U.S. followed this which stated that every monetary unit had to be backed by either gold or silver.

1913 Federal Reserve Act: This created the Federal Reserve system (“the Fed” which started issuing promissory notes (paper money) that could be redeemed for gold on demand.

Executive Order 6102 of 1933: President Franklin D. Roosevelt required everyone to deliver their gold to the Federal Reserve in exchange for $20.67 per troy ounce. This made the trade and possession of gold of more than $100 a criminal offense. The Treasury then changed the price from $20.67 to $35 per troy ounce to increase the value of their gold holdings.

Gold Reserve Act of 1934: This prohibited the Treasury and financial institutions from redeeming dollars for gold..

1971 Gold Standard Abandonment: Under President Nixon, the U.S. dollar, and by extension, the global financial system it effectively sustained, entered the era of fiat money.

Ways To Own It

There are many different ways to own the precious metal including gold jewelry, gold bullion, gold coins, gold ETF’s (what I use for clients), gold mutual funds, gold mining companies, and gold futures and options. You can read more about that here but perhaps we can do a deeper dive on that in a future newsletter.

Gold Advantages

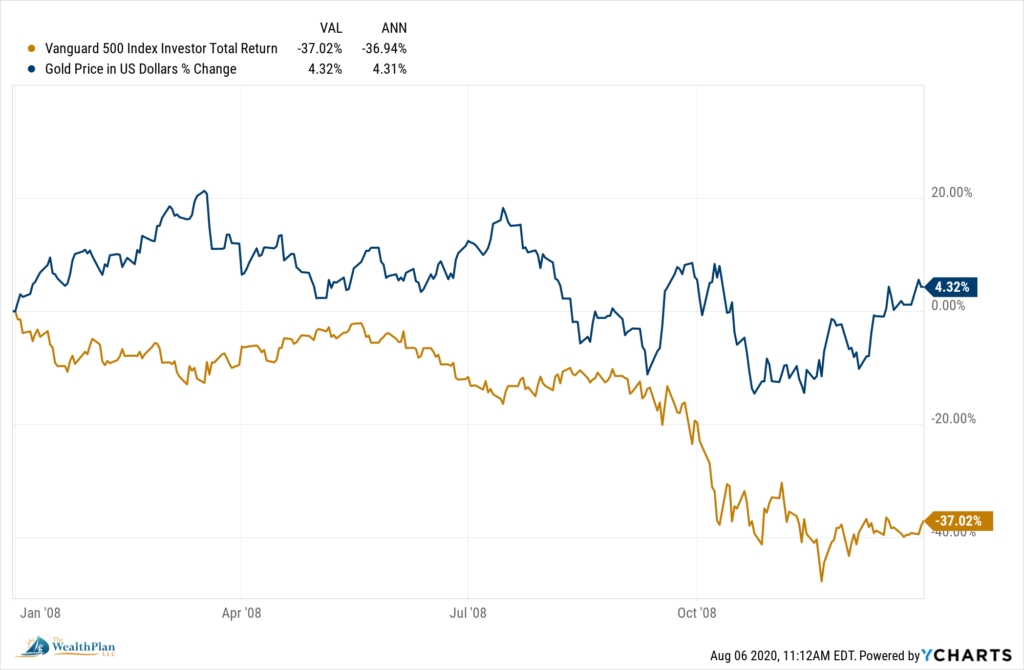

There are numerous benefits of owning gold. For starters, gold has been a store of value for over 4,000 years and has tremendous utility in that is used in jewelry. Gold services as a hedge against both inflation and deflation in that it protects your purchasing power and truly preserves your wealth. It also protects you from a falling U.S. dollar since people flock to gold for its perceived security as being “real” money. It is the ultimate fear asset in that it provides a safe haven during times of political and economic uncertainty. Lastly, it can serve as an excellent diversifier since gold has exhibited low levels of correlation with stocks, bonds, and real estate in certain years. For example, you can see in the image below how back in 2008 gold appreciated by 4% while stocks lost a whopping 37%!

Gold Disadvantages

The gold haters argue that the shiny metal is a barbaric relic that no longer holds value in our modern economy. With 92% of the worlds currency being digital, it does not contribute to any economic growth nor does it pay dividends as it is not an operating business. For those holding coins and bullion, you have the added cost of storage, risk of loss, and risk the government tries to steal it again like they did in 1933. The only way to make money with it is to sell it someone at a higher price (see “The Greater Fool Theory”) as supply and demand help determine the price of gold. It is not so much that gold is “going up,” but more that the US dollar goes down.

Investors should be aware that gold has experienced long stretches of under-performance. For example, gold was dead money for 9 straight years from August 2011 through July 2020 – until breaking to new highs recently. And if we go further back in time, we see that gold traded briefly above $800 back in January of 1980. So, in a span of 40 years, gold has increased 2.5 times, the CPI went up 3.3 times, and the S&P went up a whopping 29 times!!*

“Ok Dave – that’s great and all – but what’s the bottom line?”

I believe investors should put at least 20% in alternative investments. Gold is a part of that alternative investment universe. I allocate up to 5% to a gold exchange traded fund (ETF) in my client portfolios for its diversification benefits. With that said, it is my view that the greatest long-term inflation hedge ever crafted by man is mainstream U.S. equities. And that is where most of your money should be!

I hope this was illuminating!

P.S. A big shout-out to this article on Investopedia as this was my template for this newsletter!

P.P.S. For those that don’t like the Fed or taxes, 1913 was certainly a disaster show of a year. And you thought 2020 was bad!

With gratitude,

David Warshaw, CFP®

Click here to view the 2020 Planning Checklist.

Click here to log into your financial portal.

Click here to log into your custodial portal.

*Nick Murray Interactive, August 2020 Article, The Mind Numbing Stupidity of Gold