Dear First Mates,

Hello everyone! This month, let’s do a deep dive into the world of Long-Term Care (“LTC”). This may not be the most glamorous topic, perhaps even a bit morose, but this information is incredibly important for both you and your loved ones.

Long-term healthcare costs can devastate your retirement income security and the legacy you leave behind. Therefore, it is critical to understand the risks ahead of time and develop a plan. If you do not have a plan yet, you bear the risk of having insufficient assets to cover these necessary expenditures.

What is LTC?

Long-term care refers to nursing home care, home health care, and personal or adult day care for individuals age 65 or older with a chronic or disabling condition who require constant supervision. Most long-term care isn’t medical care. Instead, it helps with basic personal tasks of everyday life called “activities of daily living” (ADLs).

What are common ADLs?

The 6 most common ADLs are walking, feeding, dressing & grooming, toileting, bathing, and transferring (moving from one body position to another).

Why create a LTC protection plan now?

The main reasons for establishing a protection plan is: (1) to protect income/assets, (2) for peace of mind, (3) to give you more choices for care, (4) to not be a burden on family, and (5) create a future care plan while you are in good health today.

What does long-term care cost?

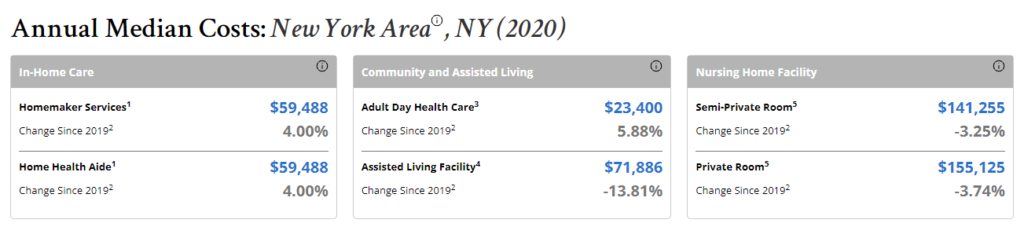

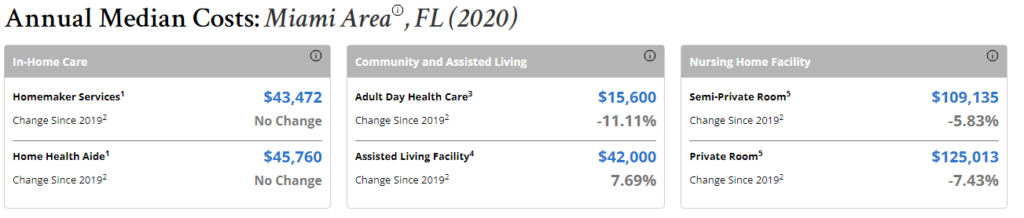

In 2020, the median annual rate for a private room in a nursing home was just over $100,000. The cost varies based on the care setting, geographic location of care, and level of care required, among other things. Unfortunately, Long-term care costs in facilities typically increase by an average of 3% to 5% annually.

The Genworth Cost of Care Survey is an excellent resource for determining the cost in your local area. I have included screenshots of the cost in both NY and Florida, which range from $43,472 to $155,125 per year.

Married couples may often face a situation where one spouse needs LTC while the other remains healthy. In these situations, the couple’s financial resources would need to cover the household costs for the healthy spouse while simultaneously paying for LTC.

What are some stats you should know?

- Research estimates that people turning 65 today have a 70% chance of needing at least one type of long-term care service.

- On average, women need care longer (3.7 years) than men (2.2 years).

- One-third of current 65-year-olds may never need long-term care support. However, 20% of that population will need it for over 5 years.

- More than 6 million Americans are living with Alzheimer’s disease, which eventually requires at least one form of long-term care support.

Where do people prefer to receive their care?

According to the AP & NORC, 88% of Americans prefer to be at home or with loved ones while receiving any ongoing living assistance. Only 12% want to receive care in a senior community or nursing home.

Won’t Medicare pay for my care?

No! Medicare does not cover LTC. Medicare will pay for 100% of the cost of care for up to 20 days at a skilled nursing facility. It would then cover approximately 80% of the cost for up to 80 more days. The included care must be for recovery following an inpatient hospital stay. Medicare will cover skilled nursing care in the home for a limited time but not non-medical care. The bottom line—do not rely on Medicare to cover custodial care.

What are my options for paying for care?

1) Self-insure

This is the do-nothing plan. For those accumulating wealth, you can modify your savings plan to create a care nest egg. For retirees, you would plan to use current income and assets to pay for care. As we have seen above, this can be expensive, costing hundreds of thousands of dollars. If you are willing to insure a $1,000 mobile phone or $50,000 car, why would you not insure against LTC costs? The self-insure option is my least favorite of the bunch.

2) Rely on Medicaid

Medicaid is America’s largest individual payer of LTC costs for impoverished individuals who meet certain income and asset requirements. Further, each state has its own requirements to be eligible for Medicaid. These requirements change yearly. To qualify, you must impoverish yourself by giving away or spending everything you own. The eligibility requirements in 2021 state that a single individual 65 years or older must have income less than $2,382 per month or up to $2,000 in countable assets. I would also advise reviewing the Medicaid Community Spouse Resource Allowance (CSRA) rules and limits.

This strategy is not my top choice because I do not think it is a realistic option for my client base. Medicaid was simply not built to provide care for the country en masse. I also question the quality of care my clients would receive and the potential for future cutbacks due to future government shortages. Generally, I prefer that the government and my clients’ LTC needs do not mix.

3) Rely on state-mandated coverage

Washington state recently passed a bill establishing an LTCi program for working residents. I wouldn’t be surprised if other states take similar action. Lawmakers want to relieve the financial stress on the Medicaid system. Although I intend to monitor these developments, I have two significant concerns. First, I fear the benefits will not be adequate coverage for long-term care. Second, I would not want my clients delaying action in hopes that these developments may eventually cover them.

4) Rely on friends and family

Some questions:

Are there people willing to provide care for you?

Can you rely on them?

Are they qualified to provide care?

Would you even want them to?

If you feel confident others will care for you, please consider their mental health and emotional capacity to do this job. The research I have seen shows that caregivers experience higher depressive symptoms and mental health problems compared to their non-caregiving peers. While I wouldn’t want to place this burden on my loved ones, this decision is something only you can make based on your individual circumstances.

5) Using an irrevocable trust (as part of an overall estate plan)

The strategy here is to relinquish ownership of your assets by moving money into an irrevocable trust. The funds in the trust are then managed by a trustee for the benefit of the trust beneficiaries (family or your favorite organization). By shifting assets into the trust, individuals may qualify for Medicaid while preserving a portion of their wealth for both themselves and their loved ones.

I have no issue with this strategy and have seen clients use it successfully. However, it is worth considering some disadvantages associated with this plan. First is the five-year “lookback” provision. This states that any money transferred into a trust five years before a person applies for Medicaid may delay benefit eligibility. Second, you may not want to relinquish control over your assets to a trust. Lastly, the government can change these laws in the future, which means more uncertainty is involved with this plan.

6) Transfer some or all the risk to an insurance company

This strategy entails purchasing an LTC insurance policy (“LTCi”). I like this strategy the most as a standalone option or in conjunction with the irrevocable trust. But more on this next month…

The bottom line is that, as of today, one should plan on needing care for about 2.5 years with a price tag of around $250,000. After all, you’ll either need care or you won’t. I view these costs as the biggest risk facing clients today. Instead of worrying about daily stock market volatility, I would strongly recommend developing an LTC strategy.

And of course, if you enjoy my newsletters, do me a solid and share it with others.

Dave’s Picks

One of the BEST Motivational Videos I’ve ever seen!

Labi Siffre – Crying, Laughing, Loving, Lying (Official HD Music Video)

getabstract (great site for book summaries)