Dear First Mates,

Hello everyone. I firmly believe that most books can be essays, essays can be an article, and articles can be one or two sentences. Time is precious, and many books don’t deliver the goods in the end. However, every now and then, you uncover a gem you have to share with others. I’m talking about “The Psychology of Money” by Morgan Housel. I can’t recommend this book enough!

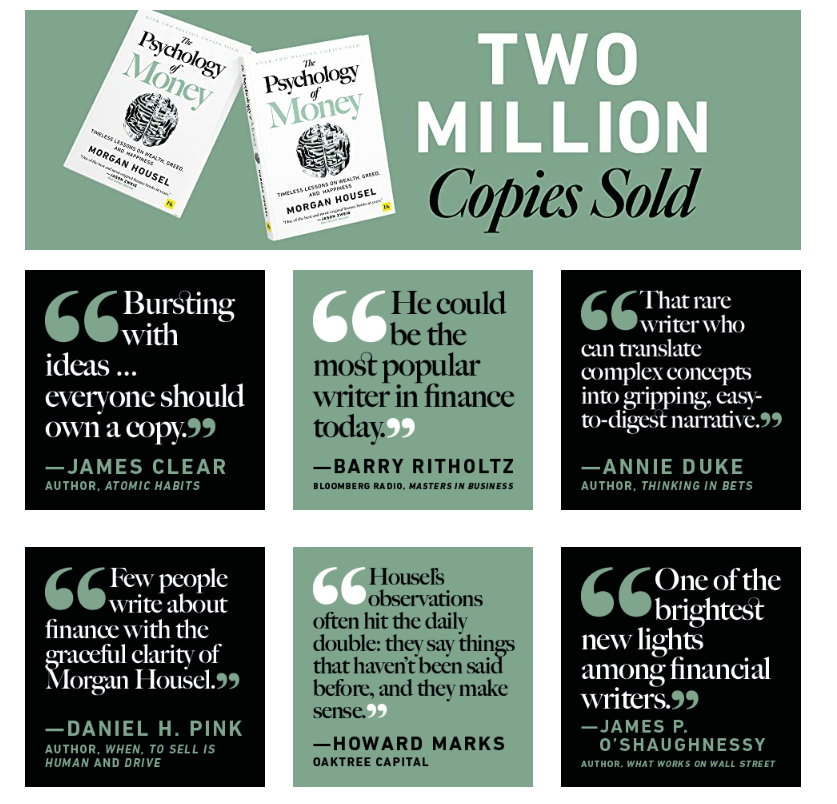

First, this book is wildly entertaining and enjoyable, even for those who don’t typically enjoy finance books. Morgan is one of the best finance writers and an incredible storyteller. Check out the book’s glowing reviews here.

Now, I don’t expect you all to drop what you are doing and read the book. Fortunately, Kyle over at Sloww created an excellent summary of the book’s key ideas. I liked his site so much that I became a premium member.

Below are some of my favorite points that really hit home for me and some of my thoughts as well:

4. Confounding Compounding

Knowing that the vast majority of Warren Buffet’s wealth came after his 65th birthday is an insane factoid, and a fantastic example of the power of compounding. To see my take on compounding, check out my “December 2020 newsletter – Compounding.“

- “$81.5 billion of Warren Buffett’s $84.5 billion net worth came after his 65th birthday.

- “His skill is investing, but his secret is time.

5. Getting Wealthy vs. Staying Wealthy

I can attest personally and professionally to the importance of having a backup plan and a backup to the backup plan. Room for error should be baked into everyone’s financial plan.

- “Planning is important, but the most important part of every plan is to plan on the plan not going according to plan …

- Room for error—often called margin of safety—is one of the most underappreciated forces in finance.

7. Freedom

Freedom, a value near and dear to my heart, is one of the most valuable things money can buy.

- “The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays.“

- “Using your money to buy time and options has a lifestyle benefit few luxury goods can compete with.”

- “Aligning money towards a life that lets you do what you want, when you want, with who you want, where you want, for as long as you want, has incredible return.”

9. Wealth is What You Don’t See

The difference between “rich” and “wealth” is crucial. Let’s aim to be wealthy – not merely rich.

- Wealth is hidden. It’s income not spent.

- “The only way to be wealthy is to not spend the money that you do have. It’s not just the only way to accumulate wealth; it’s the very definition of wealth.

- People are good at learning by imitation. But the hidden nature of wealth makes it hard to imitate others and learn from their ways.”

- Rich is a current income.

10. Save Money

Having an ample cash reserve is a cornerstone of a sound financial plan. While I generally advocate investing excess cash, there are many reasons to hold more, as evidenced below..

- “Wealth is just the accumulated leftovers after you spend what you take in. And since you can build wealth without a high income, but have no chance of building wealth without a high savings rate, it’s clear which one matters more.”

- “Less ego, more wealth. Saving money is the gap between your ego and your income, and wealth is what you don’t see.

- “Savings in the bank that earn 0% interest might actually generate an extraordinary return if they give you the flexibility to take a job with a lower salary but more purpose, or wait for investment opportunities that come when those without flexibility turn desperate.”

- “If you have flexibility you can wait for good opportunities, both in your career and for your investments. You’ll have a better chance of being able to learn a new skill when it’s necessary. You’ll feel less urgency to chase competitors who can do things you can’t, and have more leeway to find your passion and your niche at your own pace. You can find a new routine, a slower pace, and think about life with a different set of assumptions.”

11. Reasonable > Rational

This whole section is brilliant.

12. Surprise!

I’d add our news media to the list, as well as historians. Check out my “August 2019 newsletter – My Thoughts On The Media” to learn more.

- A trap many investors fall into is what I call ‘historians as prophets’ fallacy: An overreliance on past data as a signal to future conditions in a field where innovation and change are the lifeblood of progress.”

- “The most important driver of anything tied to money is the stories people tell themselves and the preferences they have for goods and services.

- History can be a misleading guide to the future of the economy and stock market because it doesn’t account for structural changes that are relevant to today’s world.”

- “The further back in history you look, the more general your takeaways should be.

- Historians are not prophets.”

15. Nothing’s Free

Investing isn’t easy. This is why it’s important to have proper expectations before investing.

- “Like everything else worthwhile, successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret—all of which are easy to overlook until you’re dealing with them in real time.”

- “The trick is convincing yourself that the market’s fee is worth it. That’s the only way to properly deal with volatility and uncertainty—not just putting up with it, but realizing that it’s an admission fee worth paying. There’s no guarantee that it will be.”

- “Define the cost of success and be ready to pay for it. Because nothing worthwhile is free.”

17. The Seduction of Pessimism

One of my core investing principles is optimism. And I admit that being optimistic sounds a tad salesy. That said, I think it’s the only way to live. And I don’t know how to help pessimistic people become successful investors. It usually doesn’t work because they think the sky is always falling. To learn more about my investing principles, check out my January 2021 newsletter- First Principles.

- “Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you.”

- “Pessimists often extrapolate present trends without accounting for how markets adapt.”

- “Progress happens too slowly to notice, but setbacks happen too quickly to ignore.”

- “It’s easier to create a narrative around pessimism because the story pieces tend to be fresher and more recent. Optimistic narratives require looking at a long stretch of history and developments, which people tend to forget and take more effort to piece together.”

Too Long / Didn’t Read (TLDR)

Here are the main takeaways from “The Psychology of Money” by Morgan Housel:

In conclusion, I strongly recommend reading “The Psychology of Money” by Morgan Housel. Hopefully, reading this summary will motivate you to pick up a copy.

Sources & For Further Reading

SLOWW: 18 Wealth Lessons From The Psychology of Money

Tim Ferriss Podcast: Morgan Housel

Pomp Podcast Morgan Housel

Buster Benson: Cognitive Bias Cheat Sheet

Dave’s Picks

Here is my YouTube vid o’ the month!

Here is my track o’ the month!

Here is my read o’ the month!

Referral Request

Since 2004, I have made myself available to act as a sounding board for anyone who may need urgent financial advice – or just a second opinion. In that time, I’ve been able to help over 100 families. As a result, our business comes primarily through introductions. So, if you’re approached by a friend, neighbor, or family member; please let them know that I’ll always find the time to listen; and will do our best to help. I firmly believe in doing well by doing good.