“A budget is telling your money where to go instead of wondering where it went” – Dave Ramsey

Dear First Mates,

Howdy everyone? This is a very special newsletter for me as I recently became a father. Diana and I welcomed Sophia Ashraf Warshaw into this world on 4/16/2022. I wrote a detailed Facebook post on her name’s meaning for those interested. If we’re not friends on Facebook, we should totally be friends! Having a kid is a real trip I tell ya’!

There’s nothing like having a child to help you focus on budgeting. Yes, I understand many of us want to avoid this chore. Who wants to delay current gratification so that we can save for our future? But I hope to provide some insight on this not-so-fun but important topic.

Let’s start with extreme budgeting strategies popularized by both the Financial Independence, Retire Early (“FIRE”) movement and the best-selling book “The Latte Factor” by David Bach.

The FIRE movement is all about having a lifestyle defined by frugality, extreme savings, and investment – with adherents saving up to 70% of their annual income. The goal of FIRE is to retire super early in your 30s or 40s, while having saved sufficient funds to live the life the investor desires.

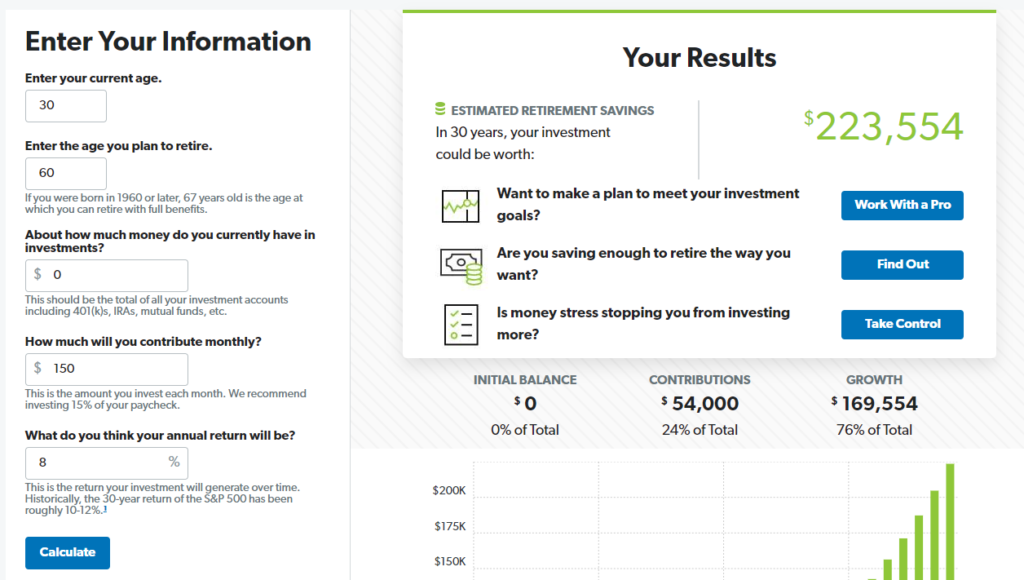

One way to FIRE is to frequently utilize The Latte Factor, which is how small amounts of money regularly spent can cost far more than we can imagine over time. As you can see in the image below, ditching that $5 coffee and investing $5 instead can grow to a hefty sum!

These ideas can foster discipline, fiscal responsibility, and delayed gratification. All good stuff. However, I am not a big proponent of sacrificing today for an imaginary tomorrow. I want clients to live happy lives, as each day on Earth is a blessing. Worrying about the opportunity cost of each measly purchase is a significant burden.

Therefore, it can be beneficial to obtain clarity on your monthly spending. The first step is to know where the money is going each month – with no judgment involved. Just the facts! The next step is to determine if you should curtail spending in a particular area to benefit another.

This is the part of budgeting that ruffles some feathers, because many people translate spending more into more happiness. While it may be true for some, happiness is ultimately about having options to do what you want, when you want, and where you want. Those options are found from saving and investing – which are the opposite of spending! In essence, a budget helps you:

1) figure out goals, so you allocate to what’s most important

2) illuminate if your values reflect in your spending

3) ensure you only save money that you have available

4) shed light on bad spending habits

5) take control of your spending which can help reduce stress and worry

Tip: You don’t have to do the budget every month but rather when you feel like you are losing grip on spending or experiencing significant lifestyle changes. I’d rather you do a budget three times a year than never!

Here are five tips for budgeting glory:

1) 50/30/20 rule

The 50/20/30 rule provides a good starting point for your budget. It states one should target 50% on housing, transportation, and food, 30% on discretionary spending, and 20% on savings for future you. I find 20% is a strong savings rate, but any number is better than zero!

When looking at purchases, you can also categorize them as one of the below:

(1) I had to buy that

(2) That was worth the cost

(3) That wasn’t worth the cost

(4) I can’t believe I spent that much money on that, or

(5) I should not have bought that.

2) Owe-Grow-Live-Give

We can even make budgeting simpler and allocate your budget based on only these four categories:

Owe – debt and taxes

Grow – savings

Live – spending/lifestyle

Give – charity/family

3) Custom categories

If the Owe-Grow-Live-Give feels too high level or a more detailed plan appeals to you, I recommend creating around ten categories. While you can have 50 categories, I think more is less. The most common ones are:

(1) Charity & Gifts

(2) Clothing

(3) Dining Out

(4) Education

(5) Groceries

(6) Housing

(7) Insurance

(8) Products & Services

(9) Taxes

(10) Transportation (e.g., car payments, car maintenance, gas, and tolls)’

4) Leverage technology

Most people do a back-of-the-envelope calculation in 5 minutes when guesstimating their budget. This is a good start. Unfortunately, this calculation can be way off. Instead, I would recommend using software to not only calculate your monthly expenses but also automate the process. I use simplifi, but other excellent tools include YNAB, and Mint. I think the time it takes you to learn the software and the minimal cost associated with it is well worth it!

5) Work On The Big Savings

Once you’ve seen the small to moderate expenses by using a tool like simplifi, it’s time to consider the big changes that can heavily impact your cash flow. Some examples include:

– Buy term insurance instead of whole life

– Buy used vehicles and buy cars less frequently

– Change your cable plan (or cancel it)

– Change your phone plan

– Increase deductibles on your home and auto insurance (self-insure)

– Refinance your mortgage

– Refinance other loans

– Use a cash-back credit or rewards card

– Sell your home (only half-kidding!)

In conclusion, there are many practical reasons to perform a monthly or quarterly budget. As our incomes rise, what once was considered a lavish purchase becomes everyday necessities – a concept known as lifestyle creep. Therefore, budgeting is an ongoing process. The technology available today can help you budget smarter and quicker. Budgeting doesn’t have to be a dirty word but rather an illuminating task that fosters more thoughtful monthly spending.

P.S. Here is my YouTube vid o’ the month!

P.S. Here is my music track o’ the month!

P.S. Here is my read o’ the month!

With gratitude,

David Warshaw, CFP®

Resources:

Diana (mom)- you are a rockstar and I love you very much! Sophia says hi everybody! She definitely doesn’t have Daddy’s hair color!