“Buy land, they’re not making it anymore.” – Mark Twain

Dear First Mates,

Happy Summer 2022! I hope you are all enjoying the beautiful summer weather. With much delight, I turn your attention to real estate.

Billionaire Andrew Carnegie famously said that 90% of millionaires got their wealth by investing in real estate. I’m not sure if that’s true today, but real estate does possess many wonderful investment qualities.

First things first, the real estate market is massive – currently worth around $16 trillion.

There are many different real estate sectors. The more significant categories include multifamily rentals, industrial-use buildings, office space, and retail locations. More specialty niches include hospitality, self-storage, farmland, data centers, student housing, single-family homes for rent, life science facilities, and medical offices.

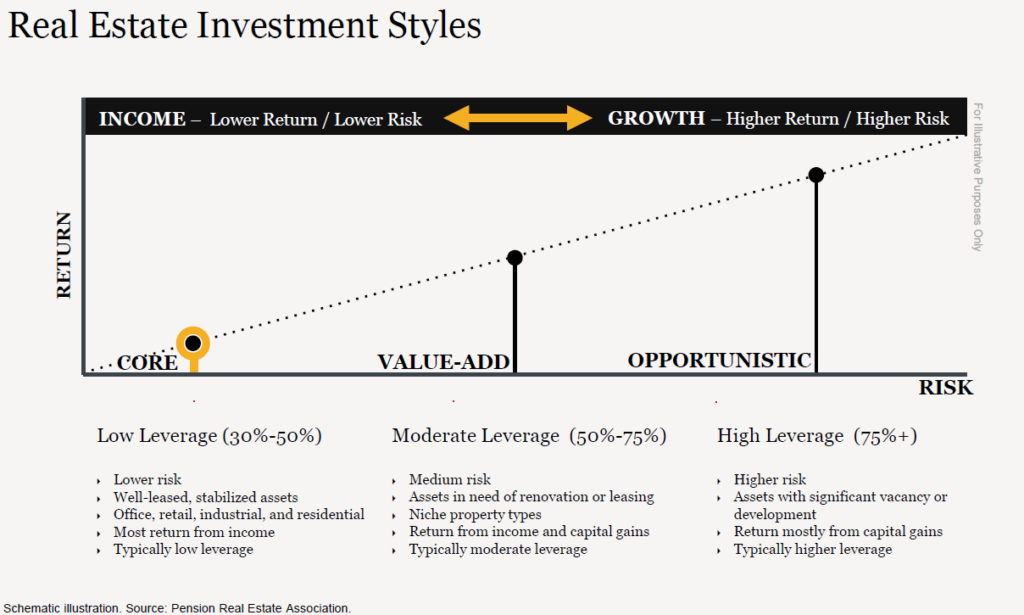

Real estate can be categorized in four ways:

1) Core

2) Core plus

3) Value-add

4) Opportunistic

Here is a good summary of each of these property types.

The primary advantages of real estate include:

1) Unique income and appreciation characteristics

2) Potential diversification benefits

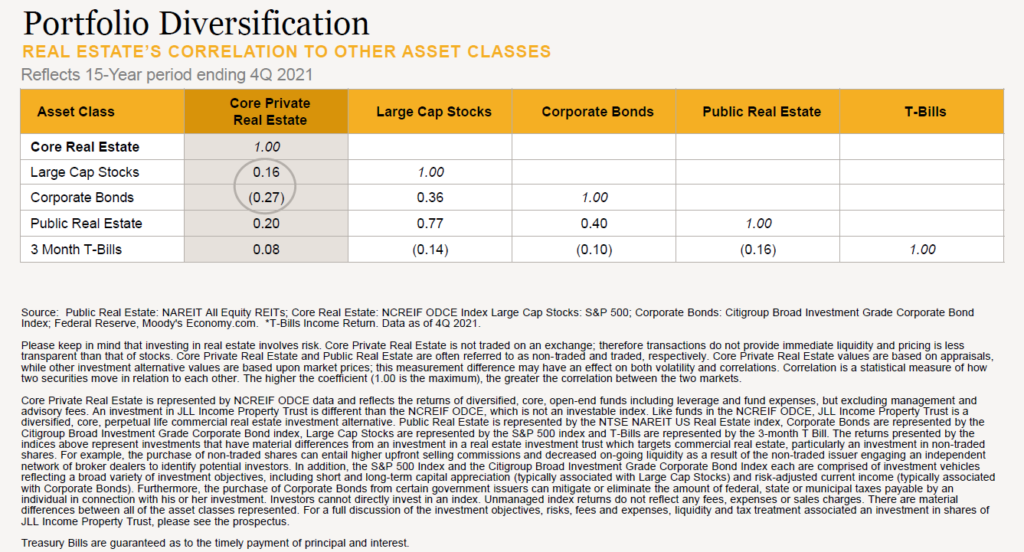

3) Low historical correlation to other asset classes

4) Tax advantages

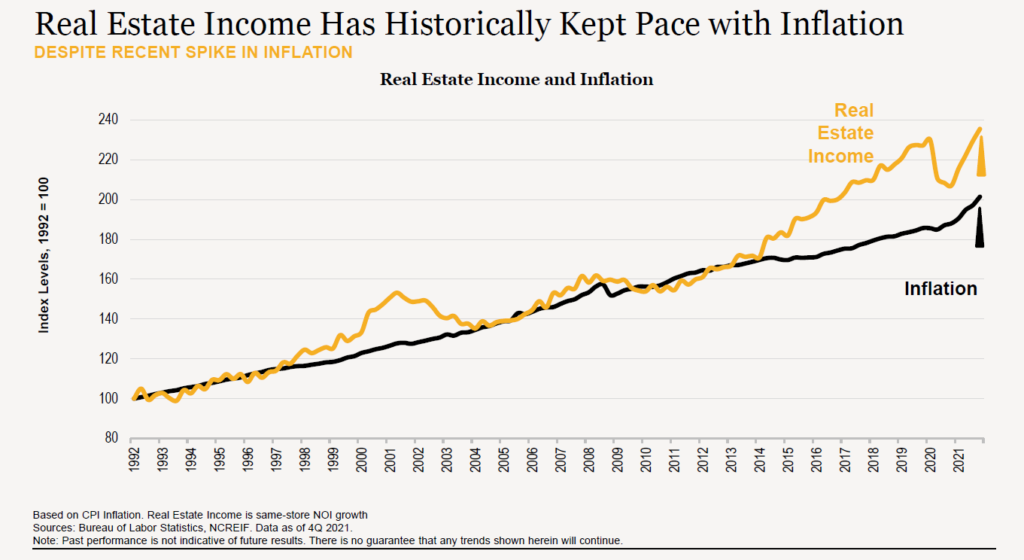

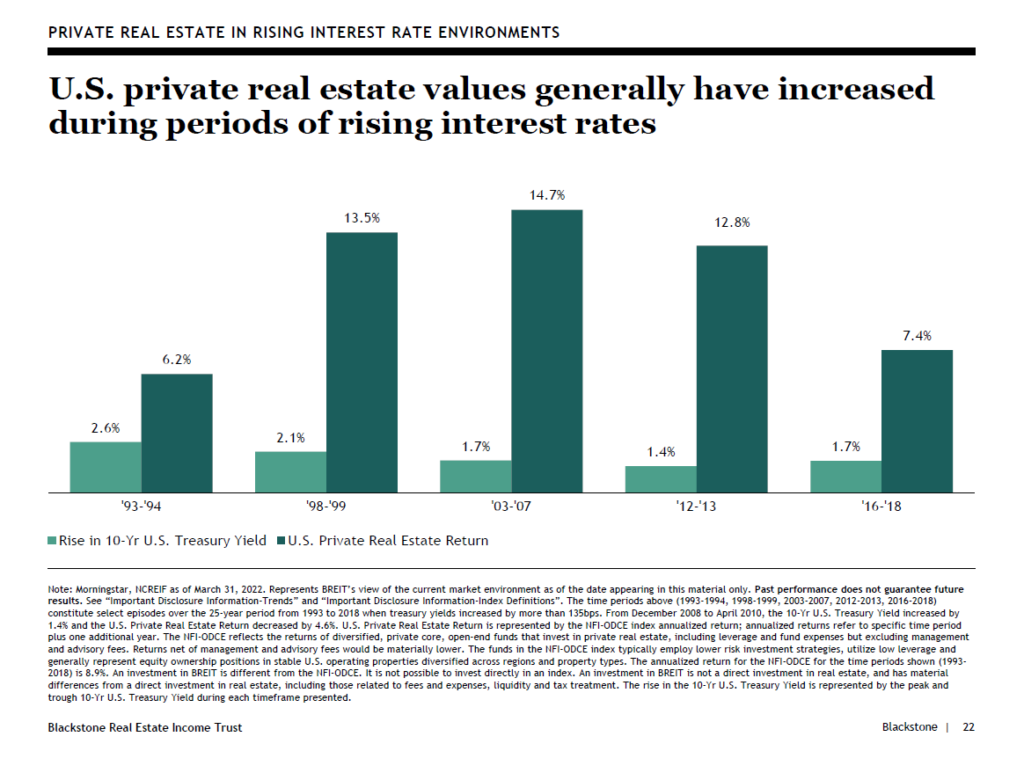

5) Has acted as a rising interest rate/inflation hedge

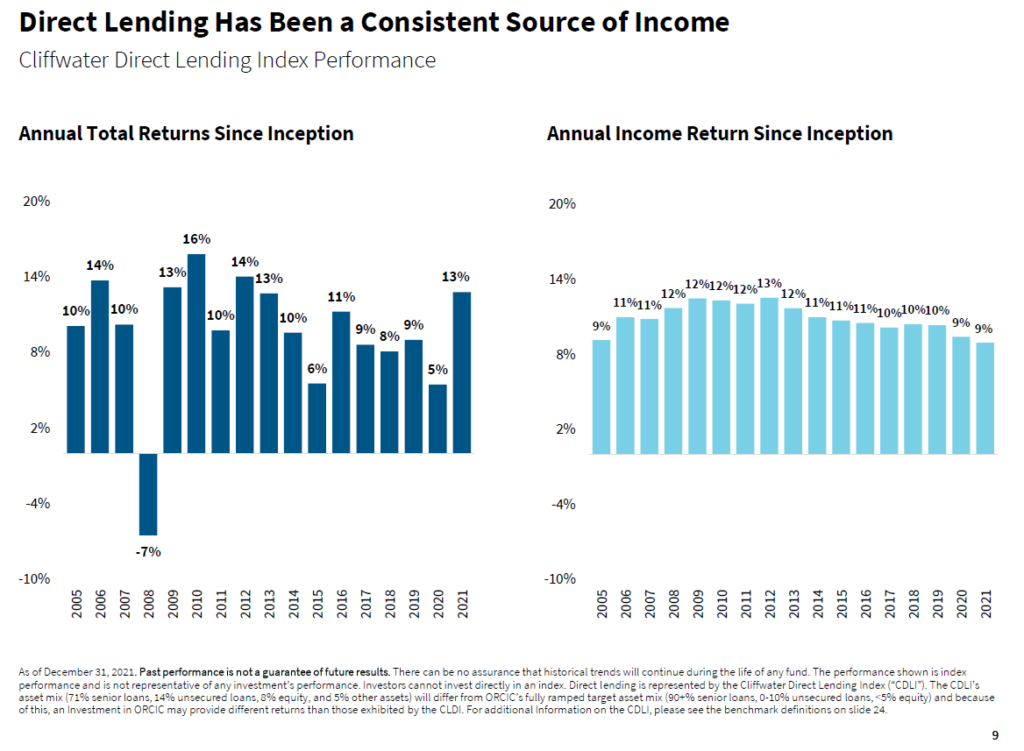

One primary reason real estate is such an attractive asset class is its strong yield component for current income. You can see in the image below how private real estate has generated an annual 4.9% yield over the last ten years. For example, a $100,000 investment would generate $4,900 per year in income.

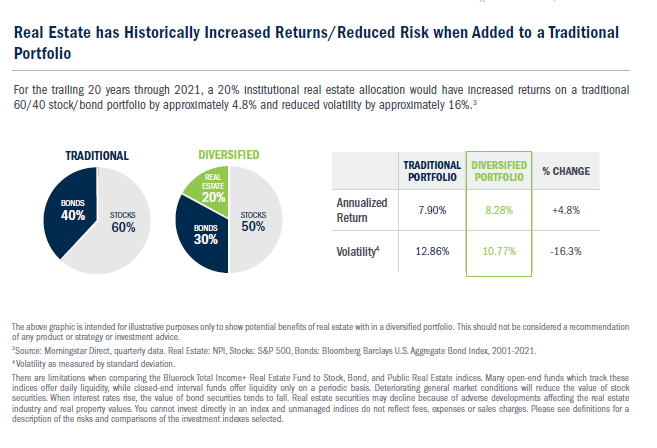

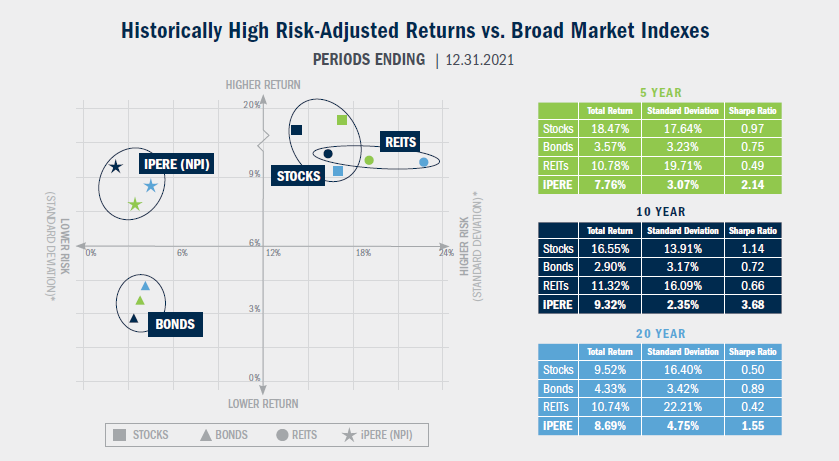

When putting real estate with other assets, like stocks and bonds, you can improve the risk/return metrics of the entire portfolio. This is because real estate zigs when other asset classes zag as they don’t move in tandem together.

In addition, real estate has numerous tax advantages. For a good summary of these benefits, check this out.

Finally, with inflation hitting a 40-year high of 8.6% and interest rates rising, real estate is an investment that can hedge these trends.

You can access real estate via both public and private markets. Public market instruments include ETFs and mutual funds. Private market instruments include private placements and interval funds.

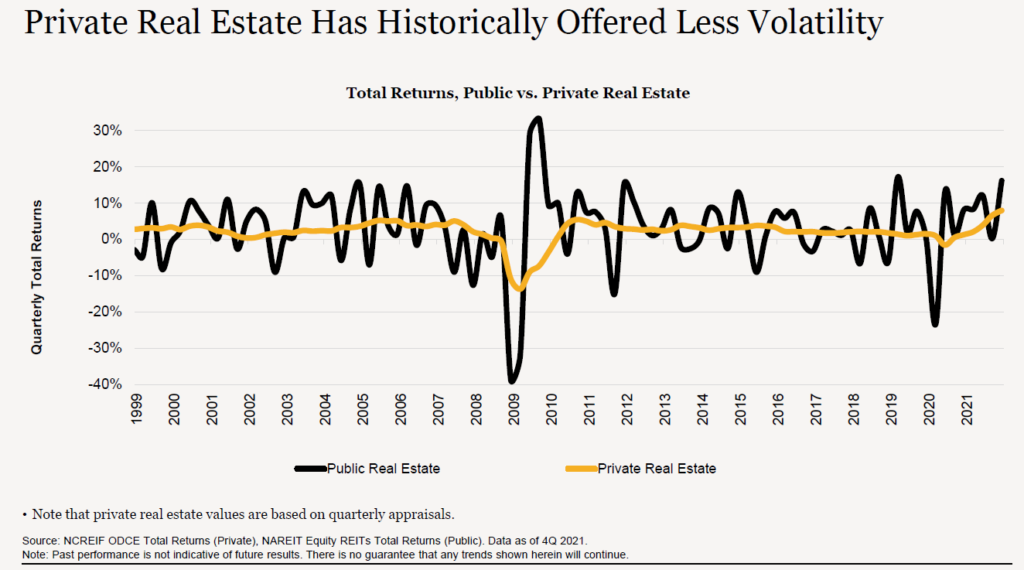

The primary advantage of public real estate is higher liquidity and the potential for higher long-term total returns. The primary benefit of private real estate is lower volatility and the potential for higher risk-adjusted returns at the expense of reduced liquidity.

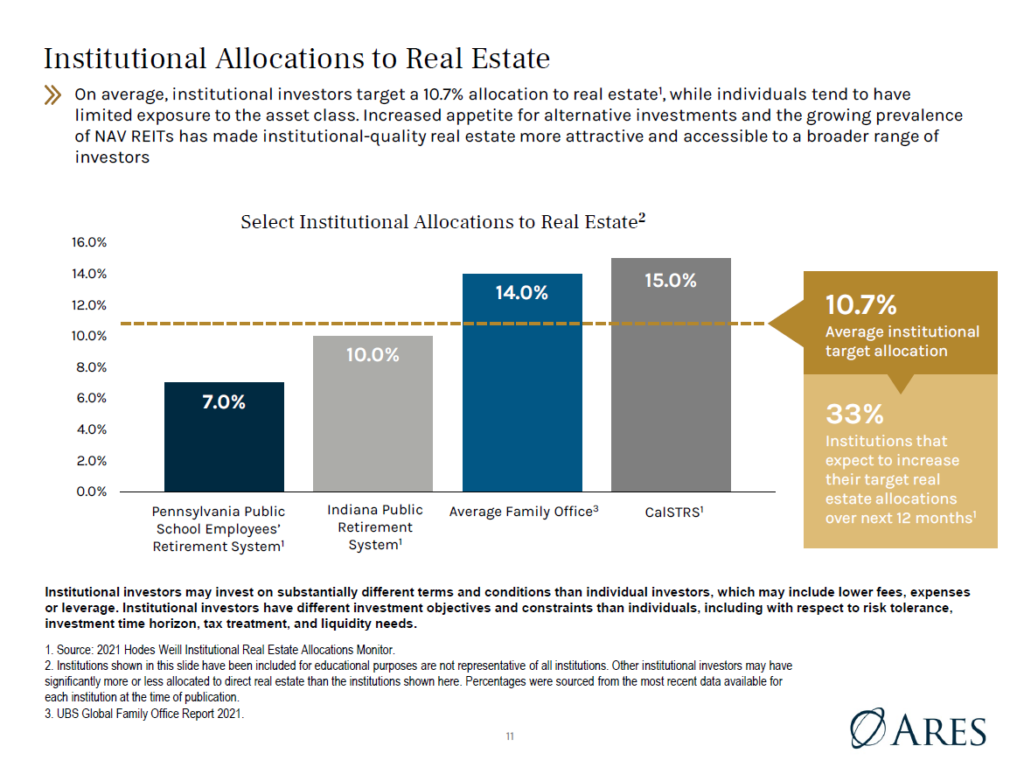

How much of a portfolio should be invested in real estate? There is no magic number since it boils down to personal preference. Institutional investors allocate 10% on average to real estate. I believe this is a reasonable estimate for retail investors (excluding your home equity).

In conclusion, real estate is a unique asset class with tremendous benefits for investors. Many fantastic solutions are available to investors today with relatively low minimums. Please schedule a meeting with me here if you’d like to learn more about real estate.

For more real estate resources, please click here and here.

P.S. Here is my YouTube vid o’ the month!

P.S. Here is my track o’ the month!

P.S. Here is my read o’ the month!

With gratitude,

David Warshaw, CFP®

You can see my newsletter archive here.